Summary

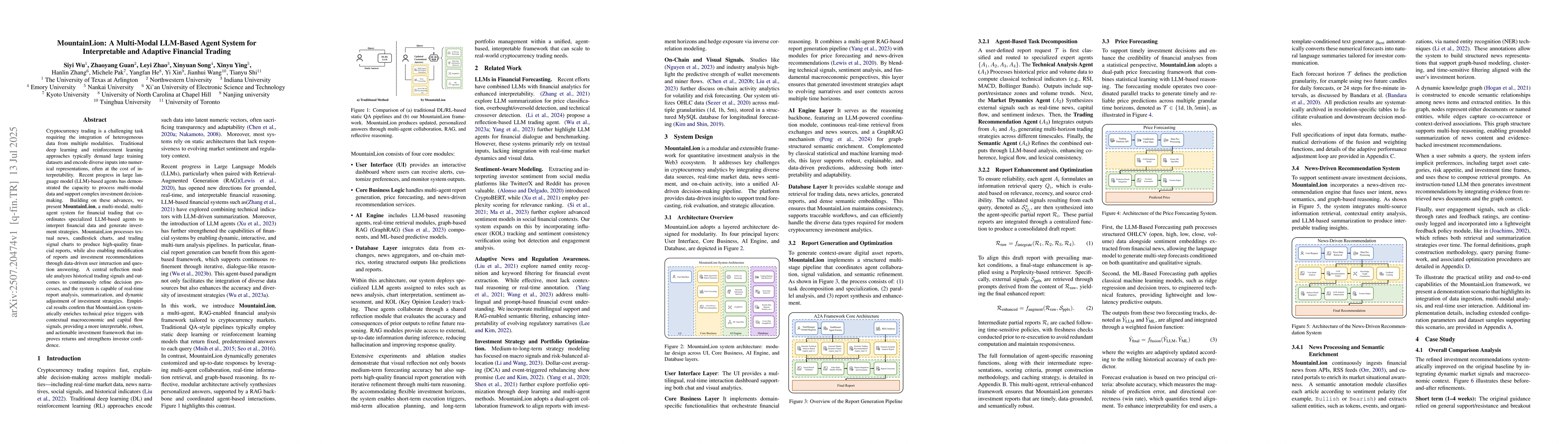

Cryptocurrency trading is a challenging task requiring the integration of heterogeneous data from multiple modalities. Traditional deep learning and reinforcement learning approaches typically demand large training datasets and encode diverse inputs into numerical representations, often at the cost of interpretability. Recent progress in large language model (LLM)-based agents has demonstrated the capacity to process multi-modal data and support complex investment decision-making. Building on these advances, we present \textbf{MountainLion}, a multi-modal, multi-agent system for financial trading that coordinates specialized LLM-based agents to interpret financial data and generate investment strategies. MountainLion processes textual news, candlestick charts, and trading signal charts to produce high-quality financial reports, while also enabling modification of reports and investment recommendations through data-driven user interaction and question answering. A central reflection module analyzes historical trading signals and outcomes to continuously refine decision processes, and the system is capable of real-time report analysis, summarization, and dynamic adjustment of investment strategies. Empirical results confirm that MountainLion systematically enriches technical price triggers with contextual macroeconomic and capital flow signals, providing a more interpretable, robust, and actionable investment framework that improves returns and strengthens investor confidence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantAgents: Towards Multi-agent Financial System via Simulated Trading

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

HedgeAgents: A Balanced-aware Multi-agent Financial Trading System

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

TradingAgents: Multi-Agents LLM Financial Trading Framework

Wei Wang, Di Luo, Yijia Xiao et al.

TradingGPT: Multi-Agent System with Layered Memory and Distinct Characters for Enhanced Financial Trading Performance

Yang Li, Yangyang Yu, Haohang Li et al.

No citations found for this paper.

Comments (0)