Summary

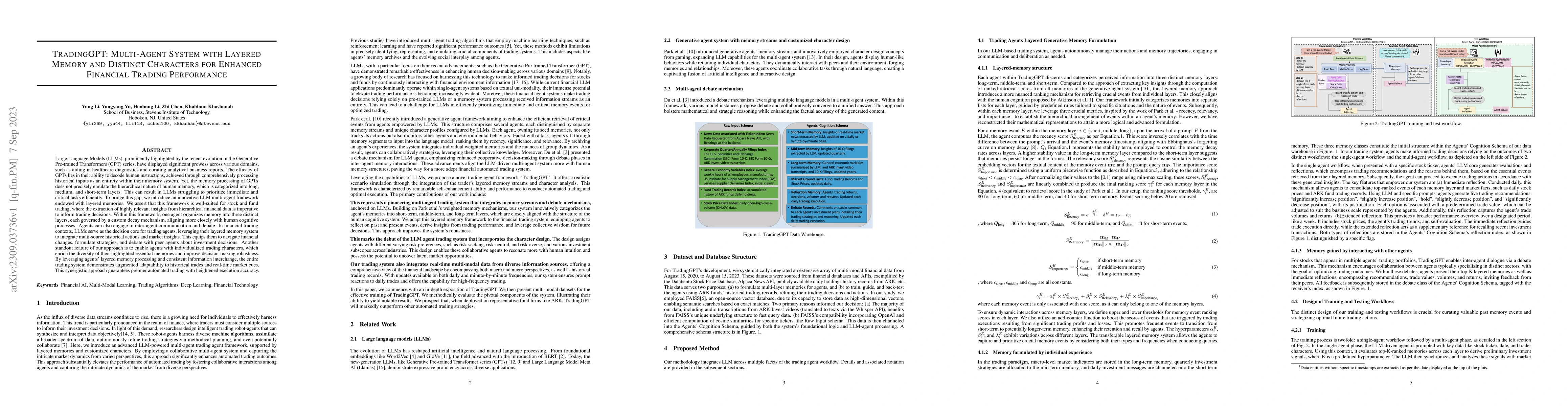

Large Language Models (LLMs), prominently highlighted by the recent evolution in the Generative Pre-trained Transformers (GPT) series, have displayed significant prowess across various domains, such as aiding in healthcare diagnostics and curating analytical business reports. The efficacy of GPTs lies in their ability to decode human instructions, achieved through comprehensively processing historical inputs as an entirety within their memory system. Yet, the memory processing of GPTs does not precisely emulate the hierarchical nature of human memory. This can result in LLMs struggling to prioritize immediate and critical tasks efficiently. To bridge this gap, we introduce an innovative LLM multi-agent framework endowed with layered memories. We assert that this framework is well-suited for stock and fund trading, where the extraction of highly relevant insights from hierarchical financial data is imperative to inform trading decisions. Within this framework, one agent organizes memory into three distinct layers, each governed by a custom decay mechanism, aligning more closely with human cognitive processes. Agents can also engage in inter-agent debate. In financial trading contexts, LLMs serve as the decision core for trading agents, leveraging their layered memory system to integrate multi-source historical actions and market insights. This equips them to navigate financial changes, formulate strategies, and debate with peer agents about investment decisions. Another standout feature of our approach is to equip agents with individualized trading traits, enhancing memory diversity and decision robustness. These sophisticated designs boost the system's responsiveness to historical trades and real-time market signals, ensuring superior automated trading accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinMem: A Performance-Enhanced LLM Trading Agent with Layered Memory and Character Design

Yang Li, Yangyang Yu, Haohang Li et al.

QuantAgents: Towards Multi-agent Financial System via Simulated Trading

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

HedgeAgents: A Balanced-aware Multi-agent Financial Trading System

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading

Tianyu Shi, Hanlin Zhang, Yi Xin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)