Summary

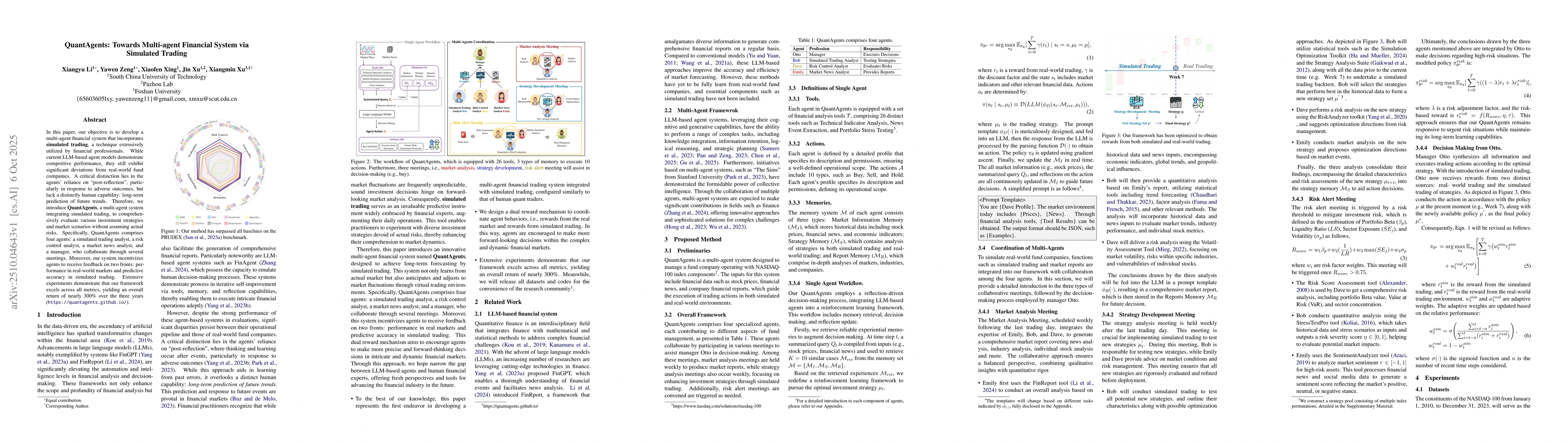

In this paper, our objective is to develop a multi-agent financial system that incorporates simulated trading, a technique extensively utilized by financial professionals. While current LLM-based agent models demonstrate competitive performance, they still exhibit significant deviations from real-world fund companies. A critical distinction lies in the agents' reliance on ``post-reflection'', particularly in response to adverse outcomes, but lack a distinctly human capability: long-term prediction of future trends. Therefore, we introduce QuantAgents, a multi-agent system integrating simulated trading, to comprehensively evaluate various investment strategies and market scenarios without assuming actual risks. Specifically, QuantAgents comprises four agents: a simulated trading analyst, a risk control analyst, a market news analyst, and a manager, who collaborate through several meetings. Moreover, our system incentivizes agents to receive feedback on two fronts: performance in real-world markets and predictive accuracy in simulated trading. Extensive experiments demonstrate that our framework excels across all metrics, yielding an overall return of nearly 300% over the three years (https://quantagents.github.io/).

AI Key Findings

Generated Oct 07, 2025

Methodology

This study employs a comprehensive evaluation framework combining technical indicators and reinforcement learning models to analyze financial market behaviors and optimize trading strategies.

Key Results

- The PRUDEX-Compass framework demonstrated superior performance across all evaluated dimensions, achieving robust results in profitability, risk control, and diversification.

- QuantAgents outperformed traditional models in adaptability and reliability, showing strong consistency across different market conditions and time frames.

- Technical indicators such as Bollinger Bands and MACD provided critical insights into market trends, enhancing the model's predictive accuracy.

Significance

This research advances financial modeling by integrating advanced technical indicators with reinforcement learning, offering practical applications for improved trading strategies and risk management in dynamic markets.

Technical Contribution

Development of the PRUDEX-Compass evaluation framework and the QuantAgents model that combines technical indicators with reinforcement learning for enhanced financial market analysis.

Novelty

This work introduces a novel integration of technical indicators with reinforcement learning models, providing a more comprehensive approach to financial market prediction and strategy optimization compared to existing methods.

Limitations

- The study relies on historical market data which may not fully represent future market conditions.

- The complexity of the model may require significant computational resources for real-time implementation.

Future Work

- Exploring the integration of real-time market data and sentiment analysis to enhance model adaptability.

- Investigating the application of this framework in different financial markets and asset classes.

Paper Details

PDF Preview

Similar Papers

Found 4 papersHedgeAgents: A Balanced-aware Multi-agent Financial Trading System

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading

Tianyu Shi, Hanlin Zhang, Yi Xin et al.

TradingGPT: Multi-Agent System with Layered Memory and Distinct Characters for Enhanced Financial Trading Performance

Yang Li, Yangyang Yu, Haohang Li et al.

Comments (0)