Authors

Summary

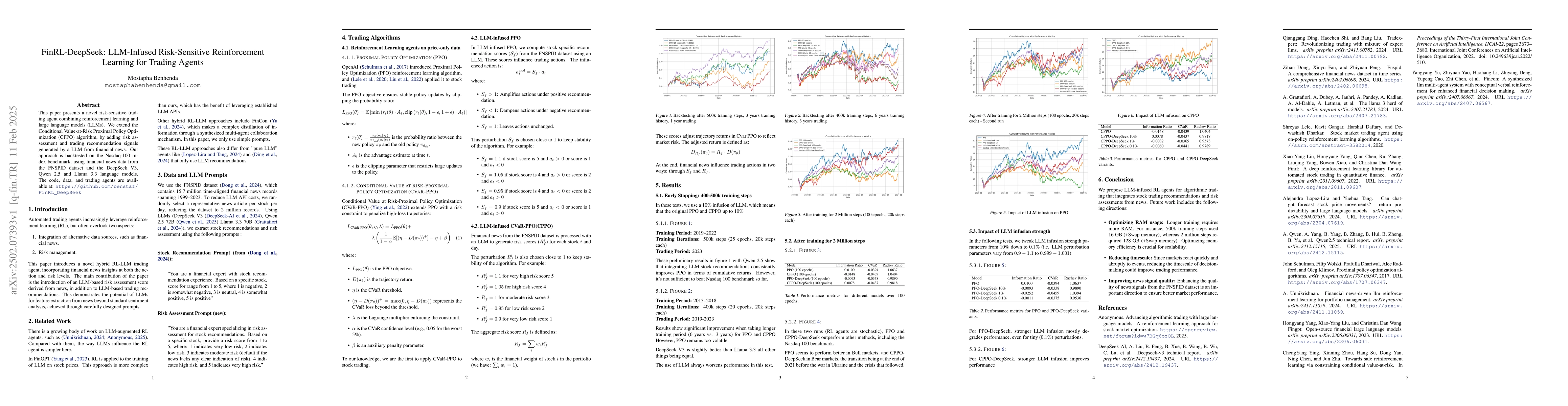

This paper presents a novel risk-sensitive trading agent combining reinforcement learning and large language models (LLMs). We extend the Conditional Value-at-Risk Proximal Policy Optimization (CPPO) algorithm, by adding risk assessment and trading recommendation signals generated by a LLM from financial news. Our approach is backtested on the Nasdaq-100 index benchmark, using financial news data from the FNSPID dataset and the DeepSeek V3, Qwen 2.5 and Llama 3.3 language models. The code, data, and trading agents are available at: https://github.com/benstaf/FinRL_DeepSeek

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper proposes FinRL-DeepSeek, an algorithm that combines reinforcement learning (specifically, the Conditional Value-at-Risk Proximal Policy Optimization or CVaR-PPO) with large language models (LLMs) to create risk-sensitive trading agents. The approach integrates stock trading recommendations and risk assessments derived from financial news using the FNSPID dataset and language models like DeepSeek V3, Qwen 2.5, and Llama 3.3.

Key Results

- Integrating LLM stock recommendations consistently improves PPO in terms of cumulative returns, although not sufficient to beat the Nasdaq100 benchmark yet.

- Significant performance improvement is observed with a longer training period (6 years vs. 3 years) for PPO and CPPO, with DeepSeek V3 slightly outperforming Llama 3.3.

- PPO and CPPO-DeepSeek outperform other methods, including the Nasdaq100 benchmark, with PPO performing better in bull markets and CPPO-DeepSeek in bear markets.

- Stronger LLM infusion generally degrades PPO performance, even with tiny (0.1%) perturbations.

- For CPPO-DeepSeek, stronger LLM infusion improves performance.

Significance

This research is significant as it introduces a novel approach to algorithmic trading by leveraging LLMs for stock recommendations and risk assessments from financial news, potentially enhancing trading agent performance and risk management.

Technical Contribution

The paper extends the CVaR-PPO algorithm by adding risk assessment and trading recommendation signals generated by LLMs from financial news, creating a risk-sensitive reinforcement learning trading agent.

Novelty

This work is novel as it combines reinforcement learning with LLMs for risk-sensitive trading, integrating financial news data to generate stock recommendations and risk assessments, which has not been extensively explored in previous research.

Limitations

- The current implementation requires substantial RAM for longer training periods.

- The timescale of decision-making could be reduced to better align with the quick and abrupt reactions of financial markets.

- The quality of news signals from the FNSPID dataset needs improvement for better market performance.

Future Work

- Optimize RAM usage for scalability during longer training periods.

- Reduce the timescale of decision-making to better capture market dynamics.

- Enhance the quality of news signals from the FNSPID dataset.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFinRL: A Deep Reinforcement Learning Library for Automated Stock Trading in Quantitative Finance

Qian Chen, Liuqing Yang, Xiao-Yang Liu et al.

No citations found for this paper.

Comments (0)