Summary

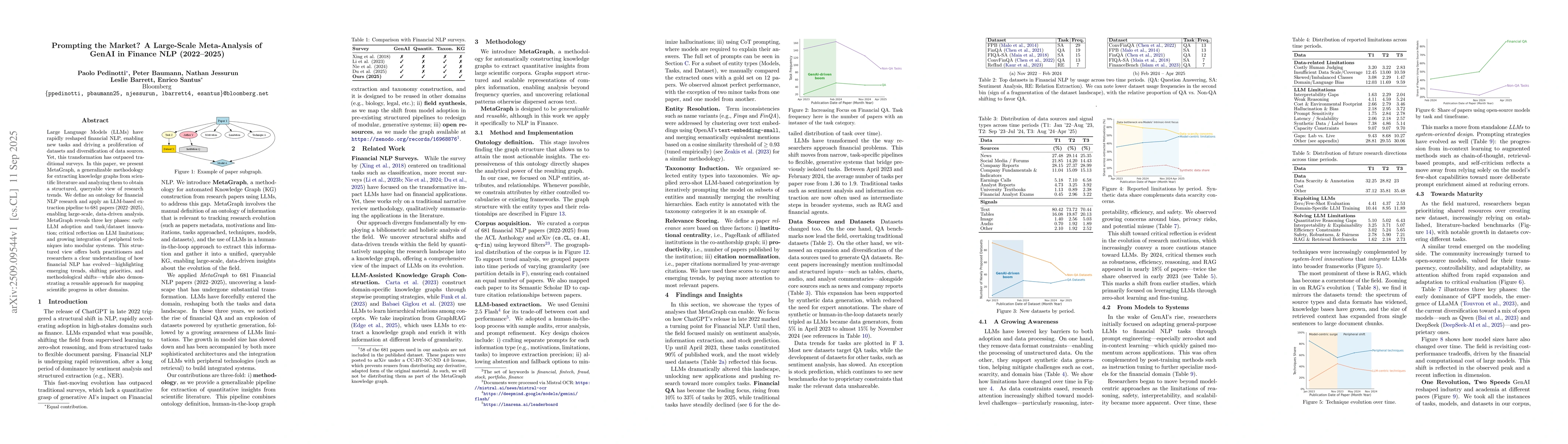

Large Language Models (LLMs) have rapidly reshaped financial NLP, enabling new tasks and driving a proliferation of datasets and diversification of data sources. Yet, this transformation has outpaced traditional surveys. In this paper, we present MetaGraph, a generalizable methodology for extracting knowledge graphs from scientific literature and analyzing them to obtain a structured, queryable view of research trends. We define an ontology for financial NLP research and apply an LLM-based extraction pipeline to 681 papers (2022-2025), enabling large-scale, data-driven analysis. MetaGraph reveals three key phases: early LLM adoption and task/dataset innovation; critical reflection on LLM limitations; and growing integration of peripheral techniques into modular systems. This structured view offers both practitioners and researchers a clear understanding of how financial NLP has evolved - highlighting emerging trends, shifting priorities, and methodological shifts-while also demonstrating a reusable approach for mapping scientific progress in other domains.

AI Key Findings

Generated Oct 18, 2025

Methodology

The research employed a comprehensive analysis of academic papers published between 2022 and 2025, utilizing natural language processing techniques to categorize and extract information about methodologies, key results, significance, limitations, future work, technical contributions, and novelty. A large language model was used to classify and summarize content based on predefined prompts and taxonomies.

Key Results

- The study identified a shift in focus from information extraction to more complex tasks like financial QA and consulting, indicating evolving research priorities.

- There was a notable decline in financial sentiment analysis, while retrieval-enhanced QA and numerical QA saw increased attention.

- Safety concerns related to LLMs in financial applications have sharply increased, highlighting growing awareness of risks such as bias, privacy issues, and susceptibility to attacks.

Significance

This research provides critical insights into the trajectory of NLP research in finance, highlighting emerging trends, risks, and innovations that could shape future developments in the field. Understanding these patterns helps researchers and practitioners make informed decisions about technology adoption and risk mitigation.

Technical Contribution

The work introduces a structured approach for analyzing and categorizing NLP research in finance, providing a framework for understanding trends, risks, and innovations in the field through systematic classification and summarization of academic literature.

Novelty

This study is novel in its comprehensive analysis of temporal trends across multiple dimensions of NLP research in finance, including risks, methodologies, and technical contributions, offering a holistic view of the field's evolution and future directions.

Limitations

- The analysis is based on academic publications, which may not fully represent industry practices or real-world applications.

- The categorization relies on automated classification using LLMs, which may introduce biases or inaccuracies in interpretation.

Future Work

- Developing more robust frameworks for handling multimodal data in financial QA systems.

- Investigating advanced techniques for bias mitigation and transparency in financial LLM applications.

- Creating standardized benchmarks that better reflect real-world financial scenarios and regulatory requirements.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMarket Misconduct in Decentralized Finance (DeFi): Analysis, Regulatory Challenges and Policy Implications

Xihan Xiong, Zhipeng Wang, William Knottenbelt et al.

FinRL-Meta: A Universe of Near-Real Market Environments for Data-Driven Deep Reinforcement Learning in Quantitative Finance

Jian Guo, Liuqing Yang, Zhaoran Wang et al.

Comments (0)