Authors

Summary

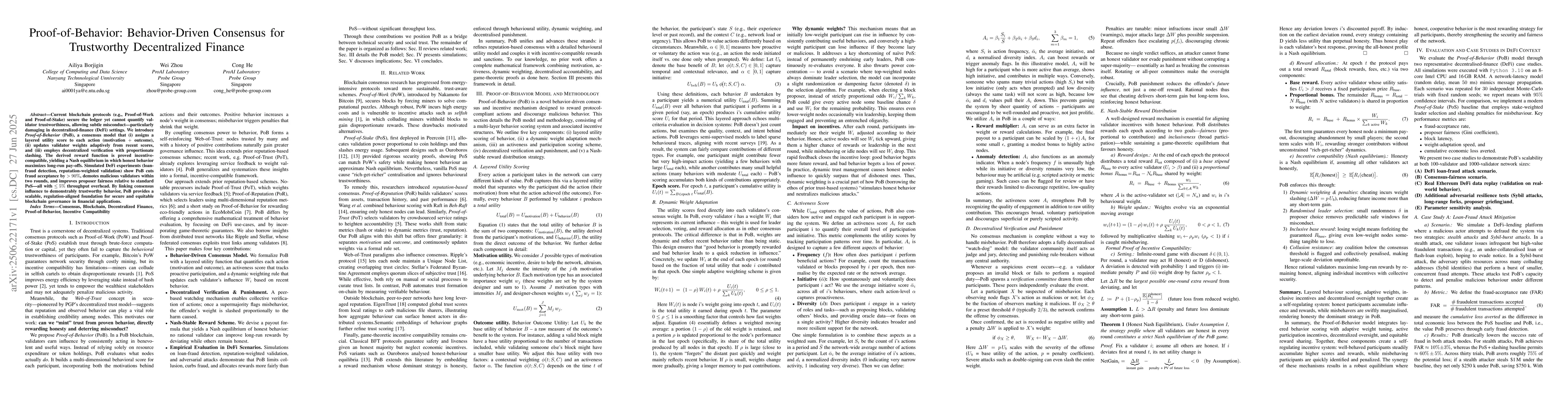

Current blockchain protocols (e.g., Proof-of-Work and Proof-of-Stake) secure the ledger yet cannot measure validator trustworthiness, allowing subtle misconduct that is especially damaging in decentralized-finance (DeFi) settings. We introduce Proof-of-Behavior (PoB), a consensus model that (i) gives each action a layered utility score -- covering motivation and outcome, (ii) adapts validator weights using recent scores, and (iii) applies decentralized verification with proportional slashing. The reward design is incentive-compatible, yielding a Nash equilibrium in which honest behavior maximizes long-run pay-offs. Simulated DeFi experiments (loan-fraud detection, reputation-weighted validation) show that PoB cuts fraud acceptance by more than 90%, demotes malicious validators within two rounds, and improves proposer fairness versus standard PoS, all with no more than a 5% throughput overhead. By linking consensus influence to verifiably trustworthy conduct, PoB offers a scalable, regulation-friendly foundation for secure and fair blockchain governance in financial applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)