Summary

This work explores the characteristics of financial contagion in networks whose links distributions approaches a power law, using a model that defines banks balance sheets from information of network connectivity. By varying the parameters for the creation of the network, several interbank networks are built, in which the concentrations of debts and credits are obtained from links distributions during the creation networks process. Three main types of interbank network are analyzed for their resilience to contagion: i) concentration of debts is greater than concentration of credits, ii) concentration of credits is greater than concentration of debts and iii) concentrations of debts and credits are similar. We also tested the effect of a variation in connectivity in conjunction with variation in concentration of links. The results suggest that more connected networks with high concentration of credits (featuring nodes that are large creditors of the system) present greater resilience to contagion when compared with the others networks analyzed. Evaluating some topological indices of systemic risk suggested by the literature we have verified the ability of these indices to explain the impact on the system caused by the failure of a node. There is a clear positive correlation between the topological indices and the magnitude of losses in the case of networks with high concentration of debts. This correlation is smaller for more resilient networks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

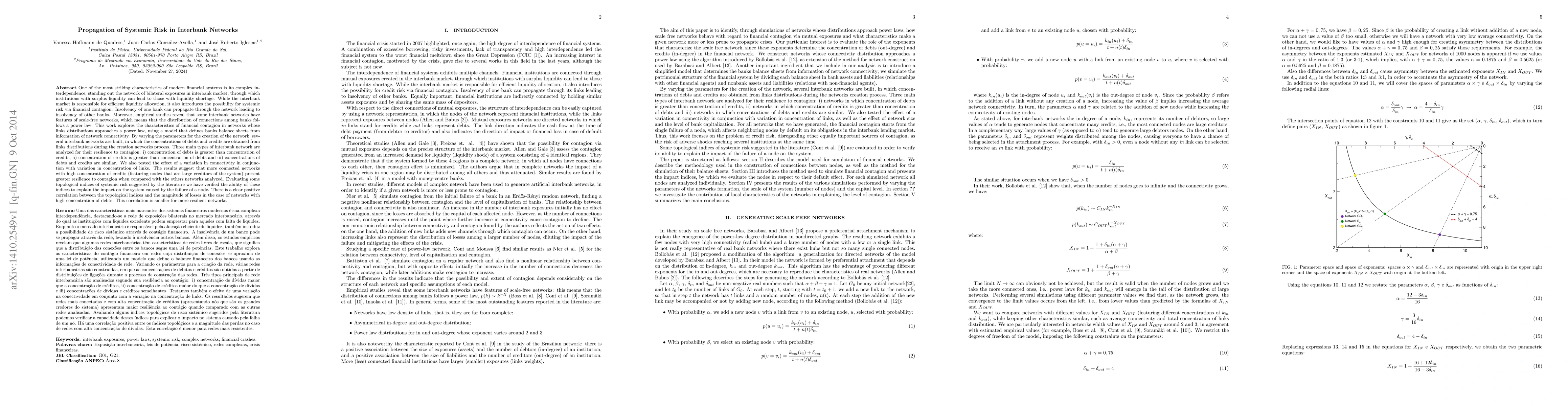

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSystemic risk in interbank networks: disentangling balance sheets and network effects

Giulio Cimini, Alessandro Ferracci

| Title | Authors | Year | Actions |

|---|

Comments (0)