Summary

Systemic liquidity risk, defined by the IMF as "the risk of simultaneous liquidity difficulties at multiple financial institutions", is a key topic in macroprudential policy and financial stress analysis. Specialized models to simulate funding liquidity risk and contagion are available but they require not only banks' bilateral exposures data but also balance sheet data with sufficient granularity, which are hardly available. Alternatively, risk analyses on interbank networks have been done via centrality measures of the underlying graph capturing the most interconnected and hence more prone to risk spreading banks. In this paper, we propose a model which relies on an epidemic model which simulate a contagion on the interbank market using the funding liquidity shortage mechanism as contagion process. The model is enriched with country and bank risk features which take into account the heterogeneity of the interbank market. The proposed model is particularly useful when full set of data necessary to run specialized models is not available. Since the interbank network is not fully available, an economic driven reconstruction method is also proposed to retrieve the interbank network by constraining the standard reconstruction methodology to real financial indicators. We show that the contagion model is able to reproduce systemic liquidity risk across different years and countries. This result suggests that the proposed model can be successfully used as a valid alternative to more complex ones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

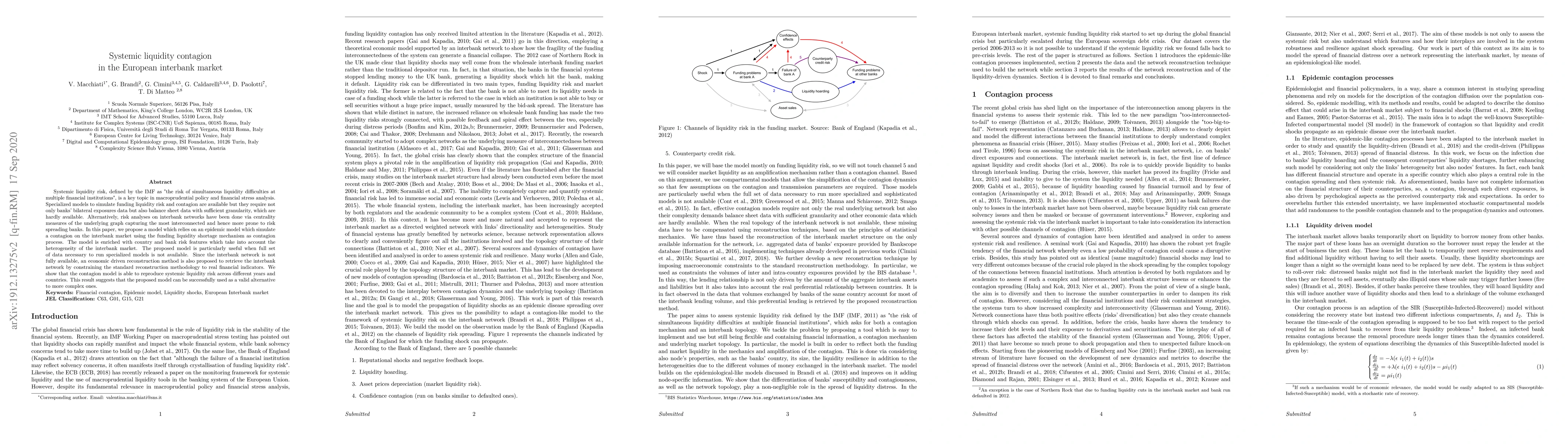

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice-mediated contagion with endogenous market liquidity

Zachary Feinstein, Zhiyu Cao

| Title | Authors | Year | Actions |

|---|

Comments (0)