Summary

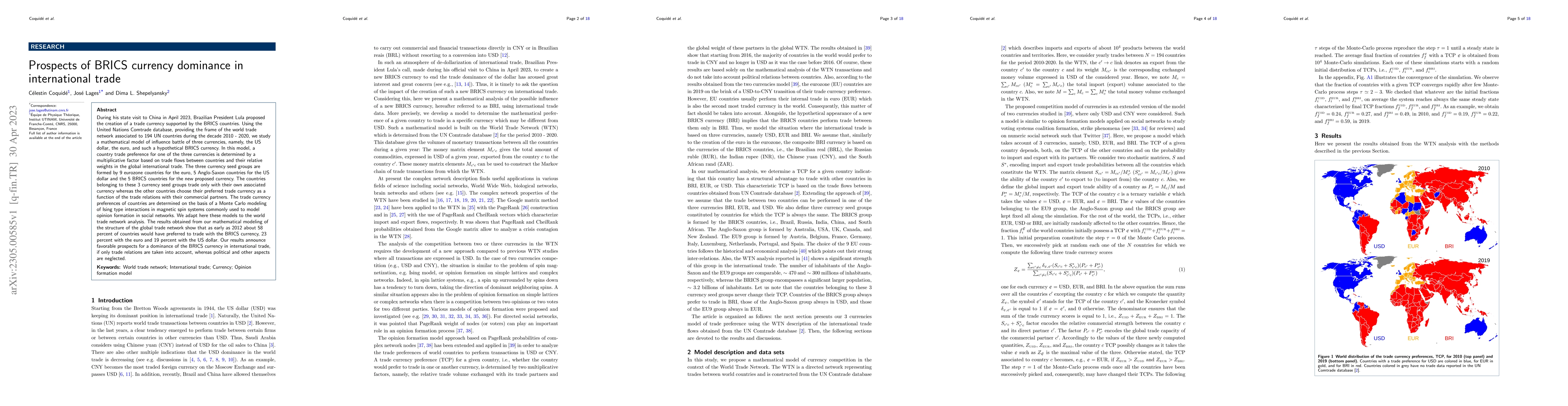

During his state visit to China in April 2023, Brazilian President Lula proposed the creation of a trade currency supported by the BRICS countries. Using the United Nations Comtrade database, providing the frame of the world trade network associated to 194 UN countries during the decade 2010 - 2020, we study a mathematical model of influence battle of three currencies, namely, the US dollar, the euro, and such a hypothetical BRICS currency. In this model, a country trade preference for one of the three currencies is determined by a multiplicative factor based on trade flows between countries and their relative weights in the global international trade. The three currency seed groups are formed by 9 eurozone countries for the euro, 5 Anglo-Saxon countries for the US dollar and the 5 BRICS countries for the new proposed currency. The countries belonging to these 3 currency seed groups trade only with their own associated currency whereas the other countries choose their preferred trade currency as a function of the trade relations with their commercial partners. The trade currency preferences of countries are determined on the basis of a Monte Carlo modeling of Ising type interactions in magnetic spin systems commonly used to model opinion formation in social networks. We adapt here these models to the world trade network analysis. The results obtained from our mathematical modeling of the structure of the global trade network show that as early as 2012 about 58 percent of countries would have preferred to trade with the BRICS currency, 23 percent with the euro and 19 percent with the US dollar. Our results announce favorable prospects for a dominance of the BRICS currency in international trade, if only trade relations are taken into account, whereas political and other aspects are neglected.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOpinion formation in the world trade network

Dima L. Shepelyansky, Célestin Coquidé, José Lages

| Title | Authors | Year | Actions |

|---|

Comments (0)