Authors

Summary

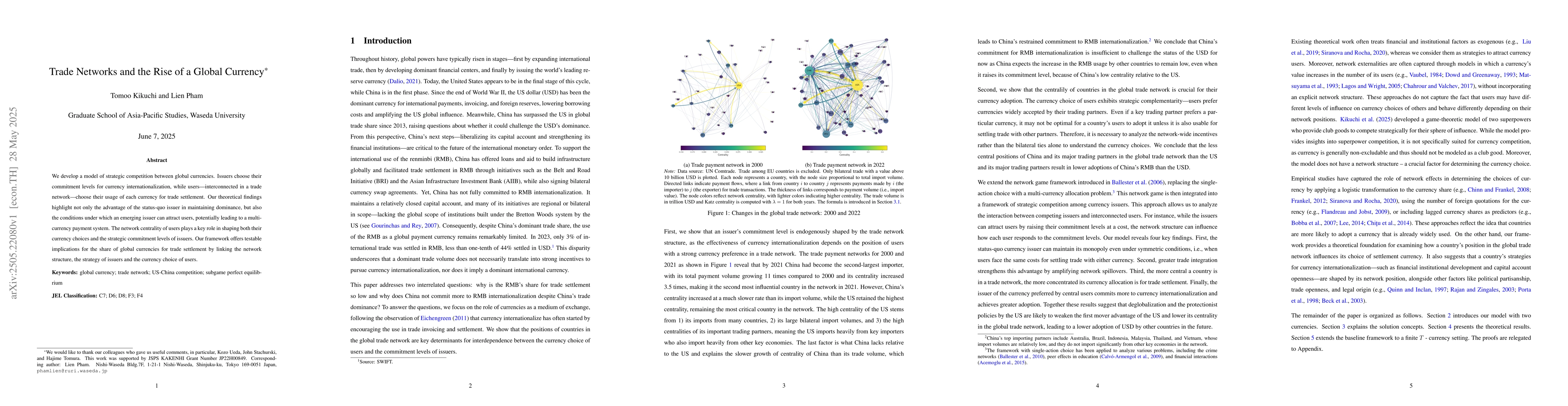

We develop a model of strategic competition between global currencies. Issuers choose their commitment levels for currency internationalization, while users -- interconnected in a trade network -- choose their usage of each currency for trade settlement. Our theoretical findings highlight not only the advantage of the status-quo issuer in maintaining dominance, but also the conditions under which an emerging issuer can attract users, potentially leading to a multi-currency payment system. The network centrality of users plays a key role in shaping both their currency choices and the strategic commitment levels of issuers. Our framework offers testable implications for the share of global currencies for trade settlement by linking the network structure, the strategy of issuers and the currency choice of users.

AI Key Findings

Generated Jun 06, 2025

Methodology

The research develops a model of strategic competition between global currencies, focusing on issuer commitment levels for currency internationalization and user choices in a trade network for settlement.

Key Results

- The status-quo issuer maintains dominance due to inherent advantages.

- An emerging issuer can attract users under certain conditions, possibly leading to a multi-currency payment system.

- Network centrality of users significantly influences their currency choices and issuer strategic commitments.

Significance

This study offers testable implications for understanding the share of global currencies in trade settlement by linking network structure, issuer strategies, and user currency choices.

Technical Contribution

The paper presents a theoretical framework linking trade network structure, issuer strategies, and user currency choices, providing a novel approach to understanding global currency competition.

Novelty

This research distinguishes itself by integrating strategic game theory with network analysis to examine currency internationalization, offering fresh insights into the dynamics of global currency competition.

Limitations

- The model assumes rational and fully informed users and issuers, which may not reflect real-world complexities.

- It does not account for non-economic factors influencing currency adoption, such as political or historical ties.

Future Work

- Explore the impact of behavioral factors and information asymmetry on currency choices.

- Investigate the role of non-economic factors in currency adoption within the proposed framework.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProspects of BRICS currency dominance in international trade

Dima L. Shepelyansky, Célestin Coquidé, José Lages

No citations found for this paper.

Comments (0)