Authors

Summary

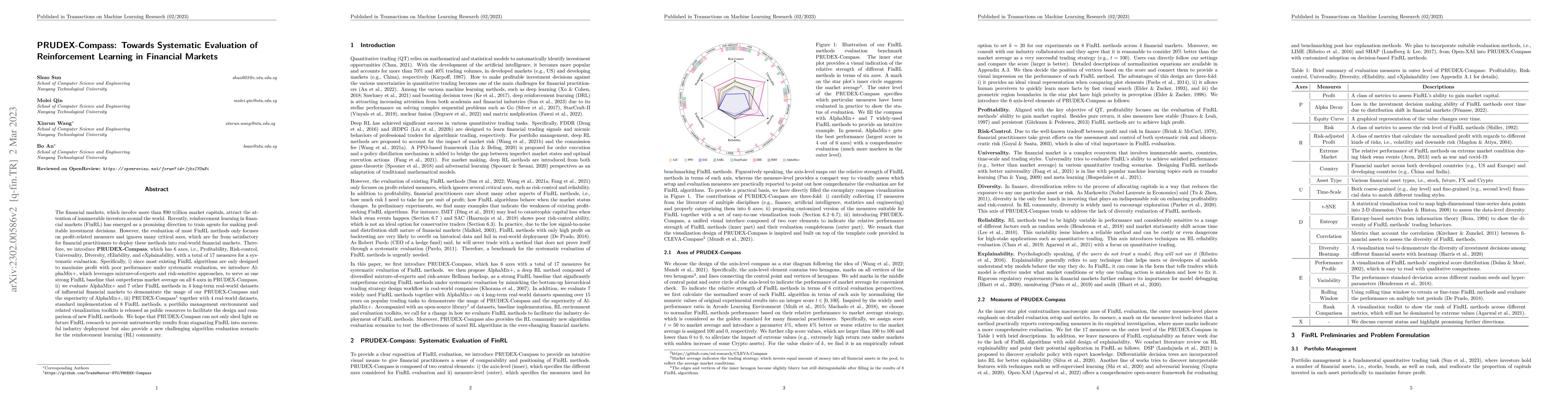

The financial markets, which involve more than $90 trillion market capitals, attract the attention of innumerable investors around the world. Recently, reinforcement learning in financial markets (FinRL) has emerged as a promising direction to train agents for making profitable investment decisions. However, the evaluation of most FinRL methods only focuses on profit-related measures and ignores many critical axes, which are far from satisfactory for financial practitioners to deploy these methods into real-world financial markets. Therefore, we introduce PRUDEX-Compass, which has 6 axes, i.e., Profitability, Risk-control, Universality, Diversity, rEliability, and eXplainability, with a total of 17 measures for a systematic evaluation. Specifically, i) we propose AlphaMix+ as a strong FinRL baseline, which leverages mixture-of-experts (MoE) and risk-sensitive approaches to make diversified risk-aware investment decisions, ii) we evaluate 8 FinRL methods in 4 long-term real-world datasets of influential financial markets to demonstrate the usage of our PRUDEX-Compass, iii) PRUDEX-Compass together with 4 real-world datasets, standard implementation of 8 FinRL methods and a portfolio management environment is released as public resources to facilitate the design and comparison of new FinRL methods. We hope that PRUDEX-Compass can not only shed light on future FinRL research to prevent untrustworthy results from stagnating FinRL into successful industry deployment but also provide a new challenging algorithm evaluation scenario for the reinforcement learning (RL) community.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)