Authors

Summary

This paper proposes a two-phase deep reinforcement learning approach, for hedging variable annuity contracts with both GMMB and GMDB riders, which can address model miscalibration in Black-Scholes financial and constant force of mortality actuarial market environments. In the training phase, an infant reinforcement learning agent interacts with a pre-designed training environment, collects sequential anchor-hedging reward signals, and gradually learns how to hedge the contracts. As expected, after a sufficient number of training steps, the trained reinforcement learning agent hedges, in the training environment, equally well as the correct Delta while outperforms misspecified Deltas. In the online learning phase, the trained reinforcement learning agent interacts with the market environment in real time, collects single terminal reward signals, and self-revises its hedging strategy. The hedging performance of the further trained reinforcement learning agent is demonstrated via an illustrative example on a rolling basis to reveal the self-revision capability on the hedging strategy by online learning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

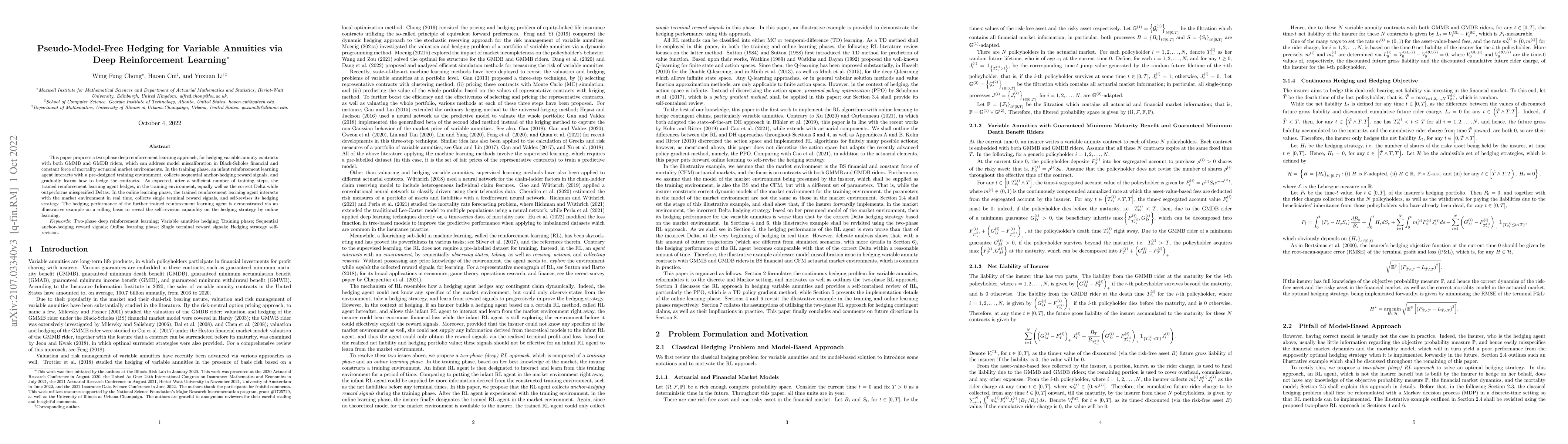

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning Algorithms for Option Hedging

Frédéric Godin, Leila Kosseim, Andrei Neagu

| Title | Authors | Year | Actions |

|---|

Comments (0)