Authors

Summary

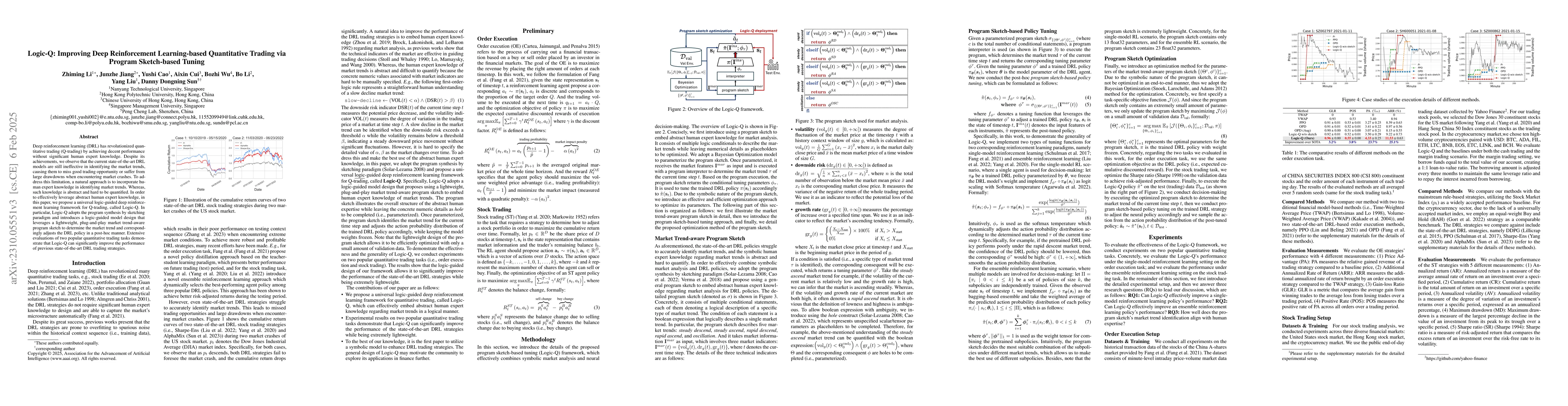

Deep reinforcement learning (DRL) has revolutionized quantitative finance by achieving decent performance without significant human expert knowledge. Despite its achievements, we observe that the current state-of-the-art DRL models are still ineffective in identifying the market trend, causing them to miss good trading opportunities or suffer from large drawdowns when encountering market crashes. To tackle this limitation, a natural idea is to embed human expert knowledge regarding the market trend. Whereas, such knowledge is abstract and hard to be quantified. In this paper, we propose a universal neuro-symbolic tuning framework, called program sketch-based tuning (PST). Particularly, PST first proposes using a novel symbolic program sketch to embed the abstract human expert knowledge of market trends. Then we utilize the program sketch to tune a trained DRL policy according to the different market trend of the moment. Finally, in order to optimize this neural-symbolic framework, we propose a novel hybrid optimization method. Extensive evaluations on two popular quantitative trading tasks demonstrate that PST can significantly enhance the performance of previous state-of-the-art DRL strategies while being extremely lightweight.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersFrom attention to profit: quantitative trading strategy based on transformer

Nicolas Langrené, Shengxin Zhu, Zhaofeng Zhang et al.

No citations found for this paper.

Comments (0)