Summary

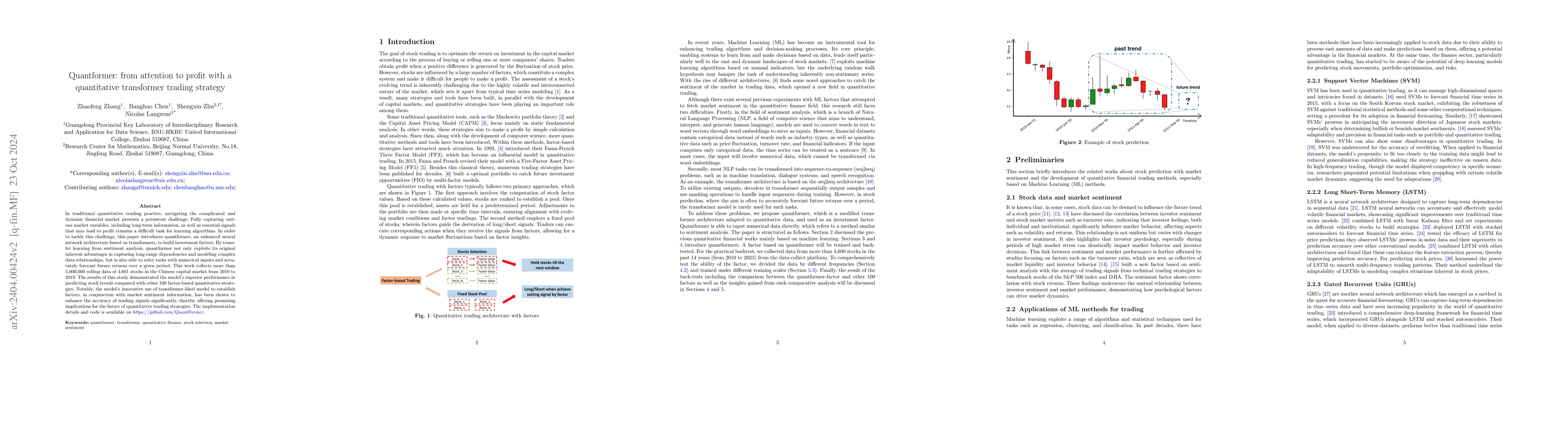

In traditional quantitative trading practice, navigating the complicated and dynamic financial market presents a persistent challenge. Former machine learning approaches have struggled to fully capture various market variables, often ignore long-term information and fail to catch up with essential signals that may lead the profit. This paper introduces an enhanced transformer architecture and designs a novel factor based on the model. By transfer learning from sentiment analysis, the proposed model not only exploits its original inherent advantages in capturing long-range dependencies and modelling complex data relationships but is also able to solve tasks with numerical inputs and accurately forecast future returns over a period. This work collects more than 5,000,000 rolling data of 4,601 stocks in the Chinese capital market from 2010 to 2019. The results of this study demonstrated the model's superior performance in predicting stock trends compared with other 100 factor-based quantitative strategies with lower turnover rates and a more robust half-life period. Notably, the model's innovative use transformer to establish factors, in conjunction with market sentiment information, has been shown to enhance the accuracy of trading signals significantly, thereby offering promising implications for the future of quantitative trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrading Under Uncertainty: A Distribution-Based Strategy for Futures Markets Using FutureQuant Transformer

Yuda Wang, Wenhao Guo, Zeqiao Huang et al.

Dynamic Grid Trading Strategy: From Zero Expectation to Market Outperformance

Jyh-Shing Roger Jang, Kai-Hsin Chen, Kai-Yuan Chen

No citations found for this paper.

Comments (0)