Summary

This paper enhances the pricing of derivatives as well as optimal control problems to a level comprising risk. We employ nested risk measures to quantify risk, investigate the limiting behavior of nested risk measures within the classical models in finance and characterize existence of the risk-averse limit. As a result we demonstrate that the nested limit is unique, irrespective of the initially chosen risk measure. Within the classical models risk aversion gives rise to a stream of risk premiums, comparable to dividend payments. In this context we connect coherent risk measures with the Sharpe ratio from modern portfolio theory and extract the Z-spread -- a widely accepted quantity in economics to hedge risk. The results for European option pricing are then extended to risk-averse American options, where we study the impact of risk on the price as well as the optimal time to exercise the option. We also extend Merton's optimal consumption problem to the risk-averse setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

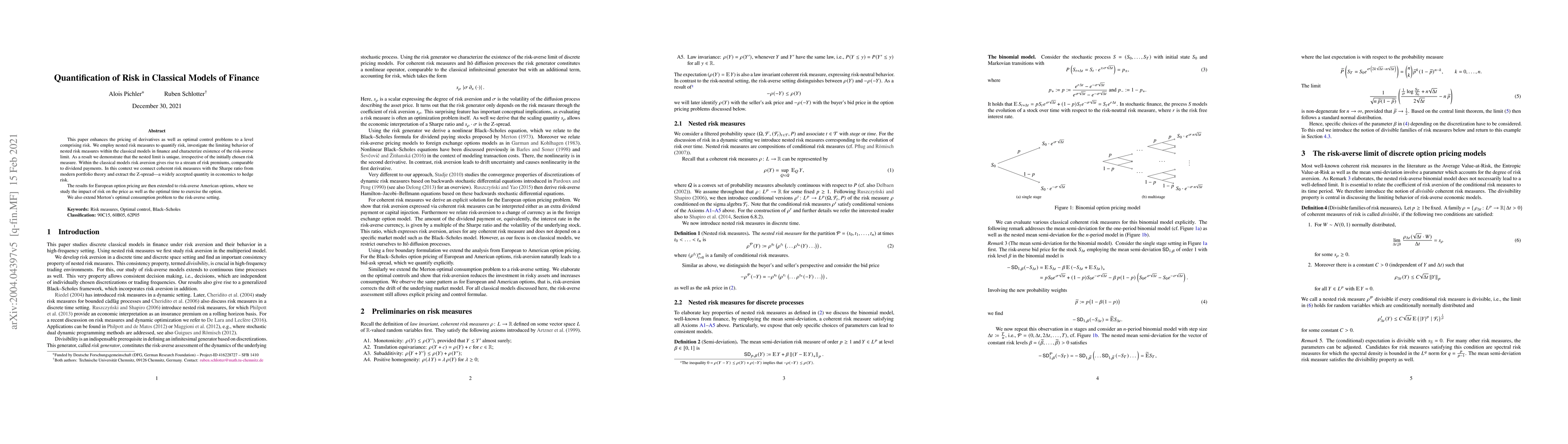

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)