Summary

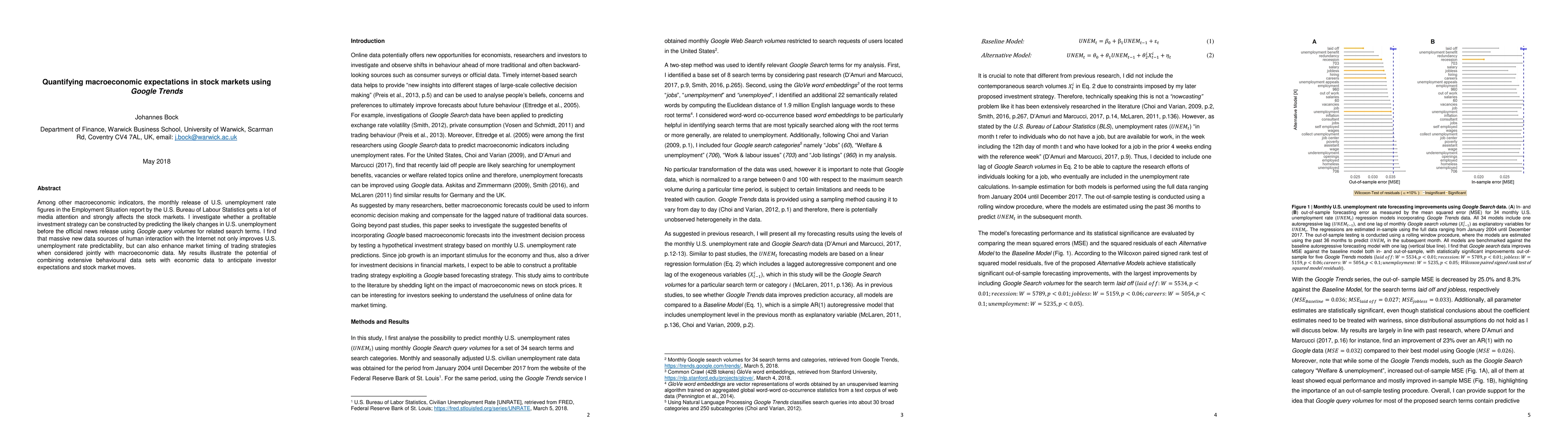

Among other macroeconomic indicators, the monthly release of U.S. unemployment rate figures in the Employment Situation report by the U.S. Bureau of Labour Statistics gets a lot of media attention and strongly affects the stock markets. I investigate whether a profitable investment strategy can be constructed by predicting the likely changes in U.S. unemployment before the official news release using Google query volumes for related search terms. I find that massive new data sources of human interaction with the Internet not only improves U.S. unemployment rate predictability, but can also enhance market timing of trading strategies when considered jointly with macroeconomic data. My results illustrate the potential of combining extensive behavioural data sets with economic data to anticipate investor expectations and stock market moves.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimulating Macroeconomic Expectations using LLM Agents

Jianhao Lin, Lexuan Sun, Yixin Yan

An Artificial Trend Index for Private Consumption Using Google Trends

Juan Tenorio, Heidi Alpiste, Jakelin Remón et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)