Summary

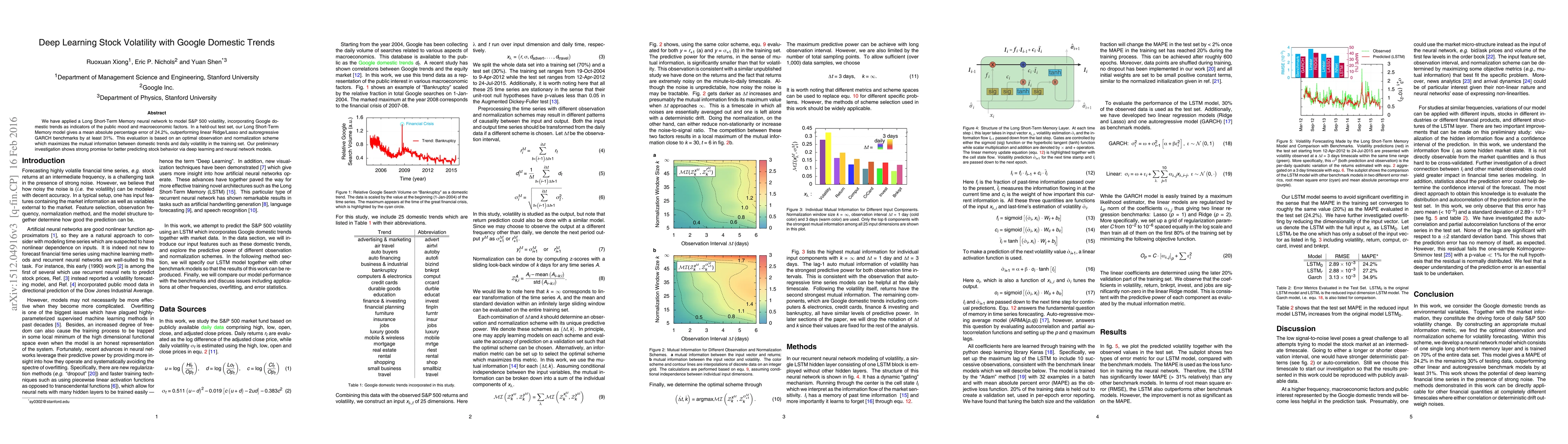

We have applied a Long Short-Term Memory neural network to model S&P 500 volatility, incorporating Google domestic trends as indicators of the public mood and macroeconomic factors. In a held-out test set, our Long Short-Term Memory model gives a mean absolute percentage error of 24.2%, outperforming linear Ridge/Lasso and autoregressive GARCH benchmarks by at least 31%. This evaluation is based on an optimal observation and normalization scheme which maximizes the mutual information between domestic trends and daily volatility in the training set. Our preliminary investigation shows strong promise for better predicting stock behavior via deep learning and neural network models.

AI Key Findings

Generated Sep 04, 2025

Methodology

A neural network model with a single long short-term memory layer was developed and trained on 70% of the dataset to forecast daily SÅ500 volatility.

Key Results

- The model achieved a mean absolute percentage error (MAPE) of 24.2% in the remaining 30% of testing data, outperforming other linear and autoregressive benchmark models.

- The use of mutual information as a feature selection criterion improved the accuracy of the model.

- The observation interval was found to be critical in determining the optimal performance of the model.

Significance

This research demonstrates the potential of deep learning techniques in financial time series forecasting, particularly in the presence of strong noise.

Technical Contribution

The development of a neural network model with a single long short-term memory layer that can effectively forecast daily SÅ500 volatility in the presence of strong noise.

Novelty

This work contributes to the growing field of financial time series forecasting by demonstrating the potential of deep learning techniques to improve accuracy and robustness.

Limitations

- The dataset used was limited to Google Trends data, which may not be representative of all financial markets.

- The model's performance was sensitive to the choice of hyperparameters and feature selection criterion.

Future Work

- Exploring the use of other machine learning algorithms and techniques, such as ensemble methods and transfer learning.

- Investigating the application of this approach to other financial time series data, such as stock prices or exchange rates.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Volatility Prediction using Time Series and Deep Learning Approach

Jaydip Sen, Ananda Chatterjee, Hrisav Bhowmick

| Title | Authors | Year | Actions |

|---|

Comments (0)