Summary

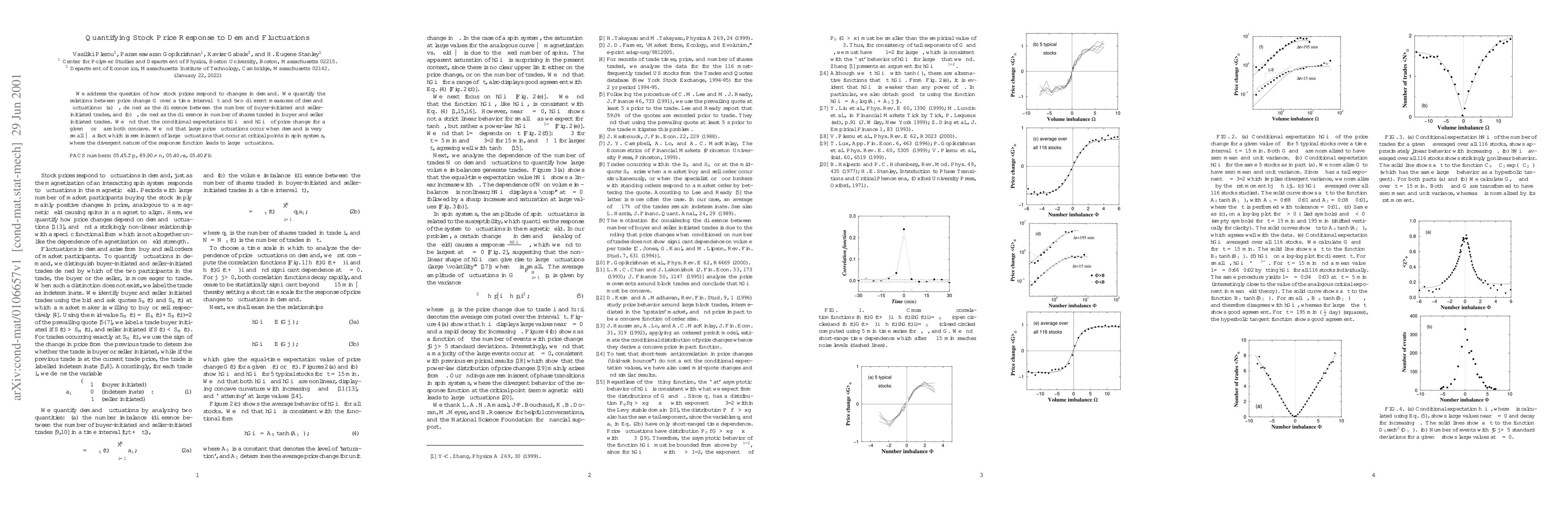

We address the question of how stock prices respond to changes in demand. We

quantify the relations between price change $G$ over a time interval $\Delta t$

and two different measures of demand fluctuations: (a) $\Phi$, defined as the

difference between the number of buyer-initiated and seller-initiated trades,

and (b) $\Omega$, defined as the difference in number of shares traded in buyer

and seller initiated trades. We find that the conditional expectations $

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)