Summary

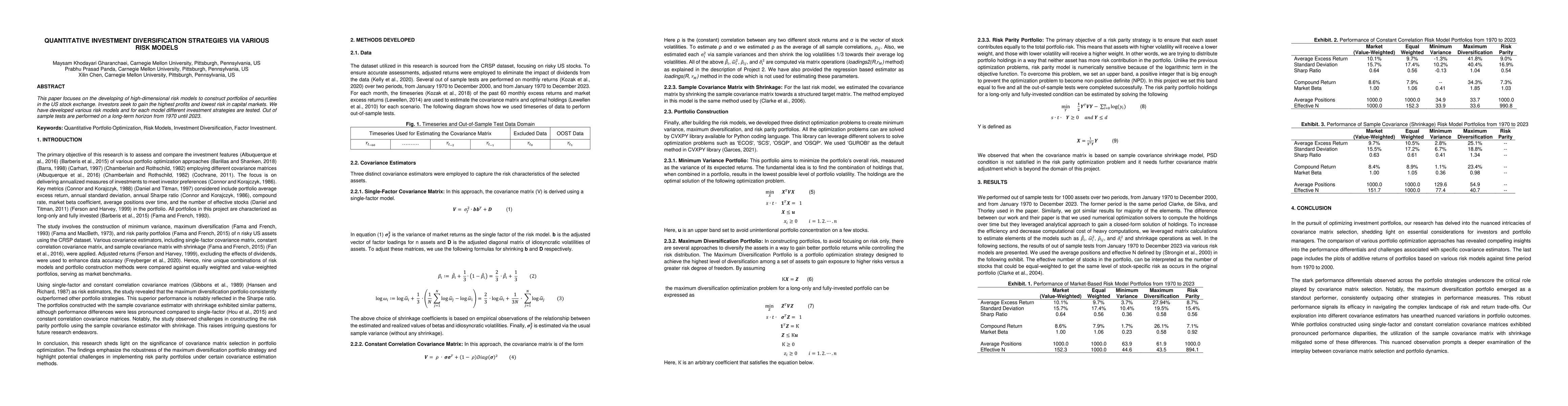

This paper focuses on the developing of high-dimensional risk models to construct portfolios of securities in the US stock exchange. Investors seek to gain the highest profits and lowest risk in capital markets. We have developed various risk models and for each model different investment strategies are tested. Out of sample tests are performed on a long-term horizon from 1970 until 2023.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiversification quotients: Quantifying diversification via risk measures

Xia Han, Liyuan Lin, Ruodu Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)