Summary

When estimating the risk of a financial position with empirical data or Monte Carlo simulations via a tail-dependent law invariant risk measure such as the Conditional Value-at-Risk (CVaR), it is important to ensure the robustness of the statistical estimator particularly when the data contain noise. Kratscher et al. [1] propose a new framework to examine the qualitative robustness of estimators for tail-dependent law invariant risk measures on Orlicz spaces, which is a step further from earlier work for studying the robustness of risk measurement procedures by Cont et al. [2]. In this paper, we follow the stream of research to propose a quantitative approach for verifying the statistical robustness of tail-dependent law invariant risk measures. A distinct feature of our approach is that we use the Fortet-Mourier metric to quantify the variation of the true underlying probability measure in the analysis of the discrepancy between the laws of the plug-in estimators of law invariant risk measure based on the true data and perturbed data, which enables us to derive an explicit error bound for the discrepancy when the risk functional is Lipschitz continuous with respect to a class of admissible laws. Moreover, the newly introduced notion of Lipschitz continuity allows us to examine the degree of robustness for tail-dependent risk measures. Finally, we apply our quantitative approach to some well-known risk measures to illustrate our theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

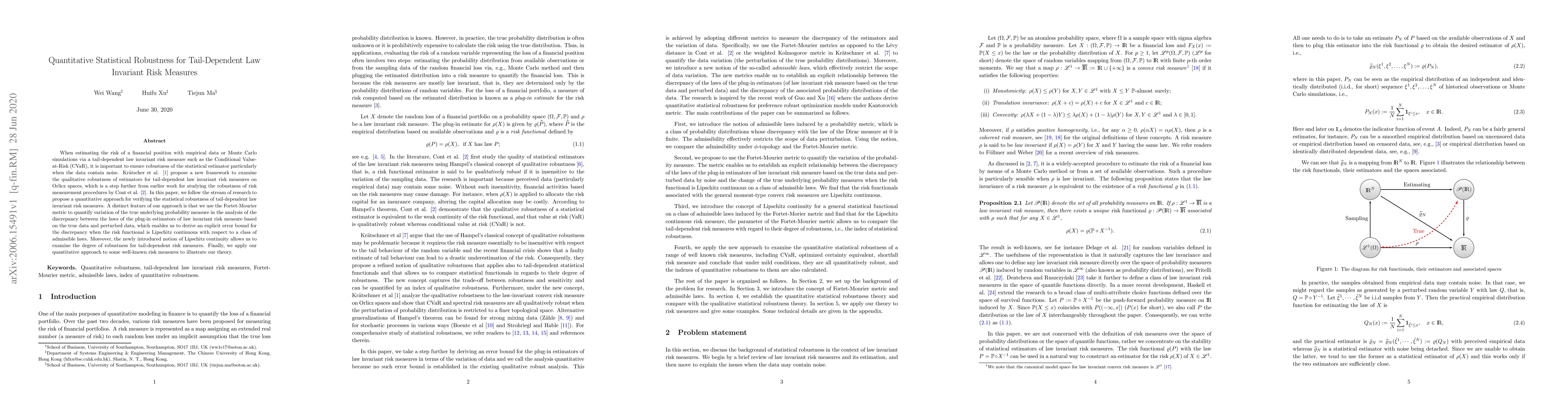

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)