Summary

We characterize when a convex risk measure associated to a law-invariant acceptance set in $L^\infty$ can be extended to $L^p$, $1\leq p<\infty$, preserving finiteness and continuity. This problem is strongly connected to the statistical robustness of the corresponding risk measures. Special attention is paid to concrete examples including risk measures based on expected utility, max-correlation risk measures, and distortion risk measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

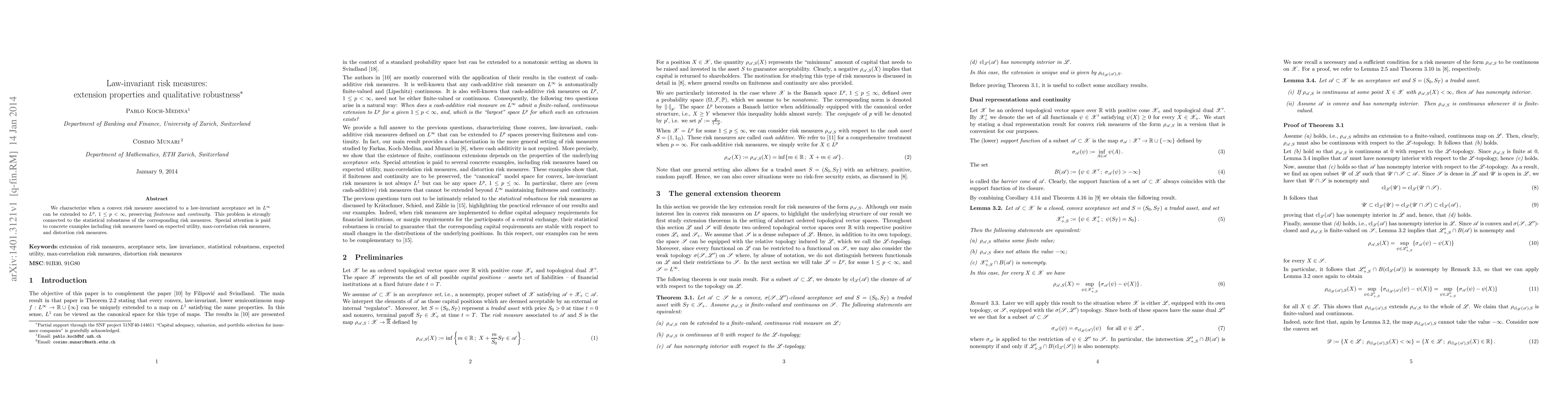

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)