Summary

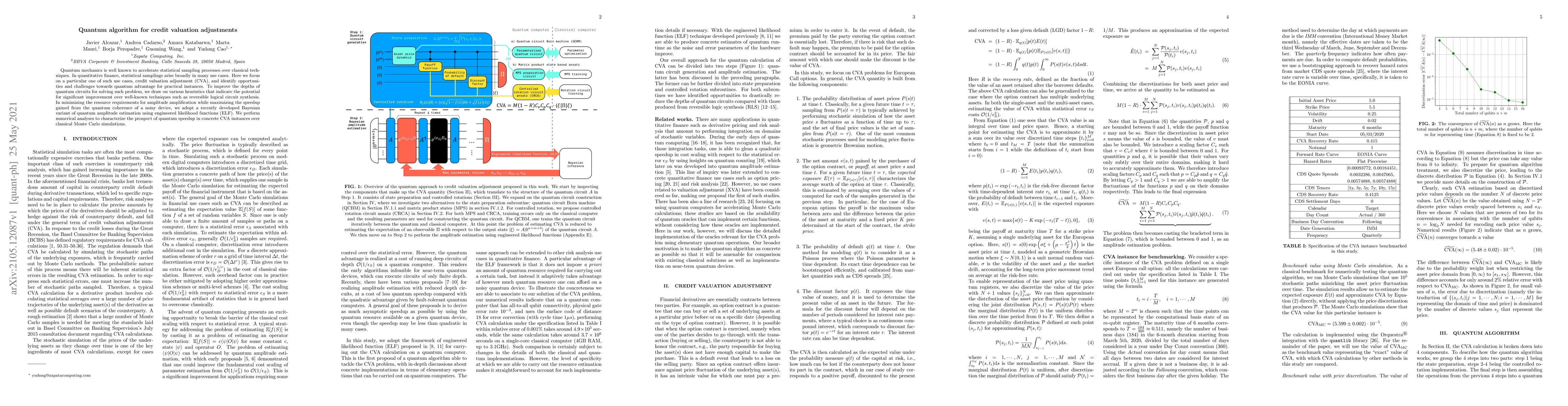

Quantum mechanics is well known to accelerate statistical sampling processes over classical techniques. In quantitative finance, statistical samplings arise broadly in many use cases. Here we focus on a particular one of such use cases, credit valuation adjustment (CVA), and identify opportunities and challenges towards quantum advantage for practical instances. To improve the depths of quantum circuits for solving such problem, we draw on various heuristics that indicate the potential for significant improvement over well-known techniques such as reversible logical circuit synthesis. In minimizing the resource requirements for amplitude amplification while maximizing the speedup gained from the quantum coherence of a noisy device, we adopt a recently developed Bayesian variant of quantum amplitude estimation using engineered likelihood functions (ELF). We perform numerical analyses to characterize the prospect of quantum speedup in concrete CVA instances over classical Monte Carlo simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)