Authors

Summary

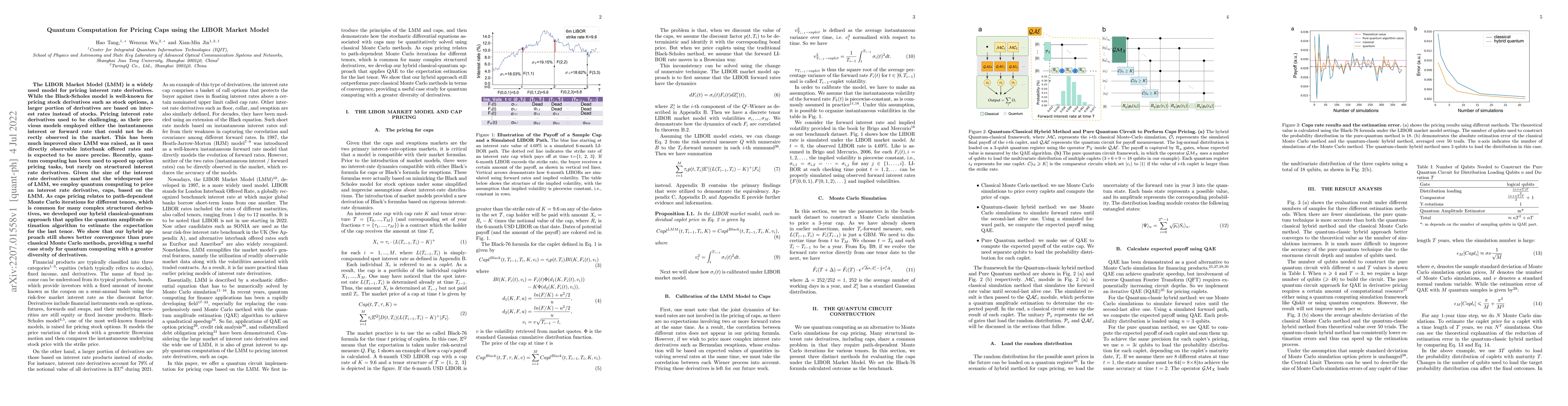

The LIBOR Market Model (LMM) is a widely used model for pricing interest rate derivatives. While the Black-Scholes model is well-known for pricing stock derivatives such as stock options, a larger portion of derivatives are based on interest rates instead of stocks. Pricing interest rate derivatives used to be challenging, as their previous models employed either the instantaneous interest or forward rate that could not be directly observed in the market. This has been much improved since LMM was raised, as it uses directly observable interbank offered rates and is expected to be more precise. Recently, quantum computing has been used to speed up option pricing tasks, but rarely on structured interest rate derivatives. Given the size of the interest rate derivatives market and the widespread use of LMM, we employ quantum computing to price an interest rate derivative, caps, based on the LMM. As caps pricing relates to path-dependent Monte Carlo iterations for different tenors, which is common for many complex structured derivatives, we developed our hybrid classical-quantum approach that applies the quantum amplitude estimation algorithm to estimate the expectation for the last tenor. We show that our hybrid approach still shows better convergence than pure classical Monte Carlo methods, providing a useful case study for quantum computing with a greater diversity of derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)