Summary

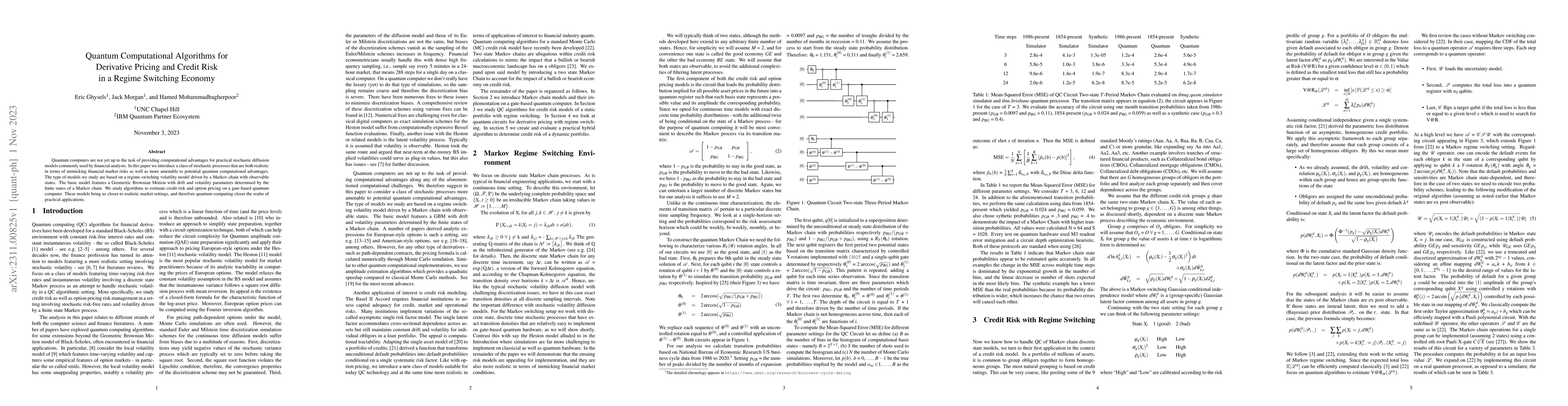

Quantum computers are not yet up to the task of providing computational advantages for practical stochastic diffusion models commonly used by financial analysts. In this paper we introduce a class of stochastic processes that are both realistic in terms of mimicking financial market risks as well as more amenable to potential quantum computational advantages. The type of models we study are based on a regime switching volatility model driven by a Markov chain with observable states. The basic model features a Geometric Brownian Motion with drift and volatility parameters determined by the finite states of a Markov chain. We study algorithms to estimate credit risk and option pricing on a gate-based quantum computer. These models bring us closer to realistic market settings, and therefore quantum computing closer the realm of practical applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)