Summary

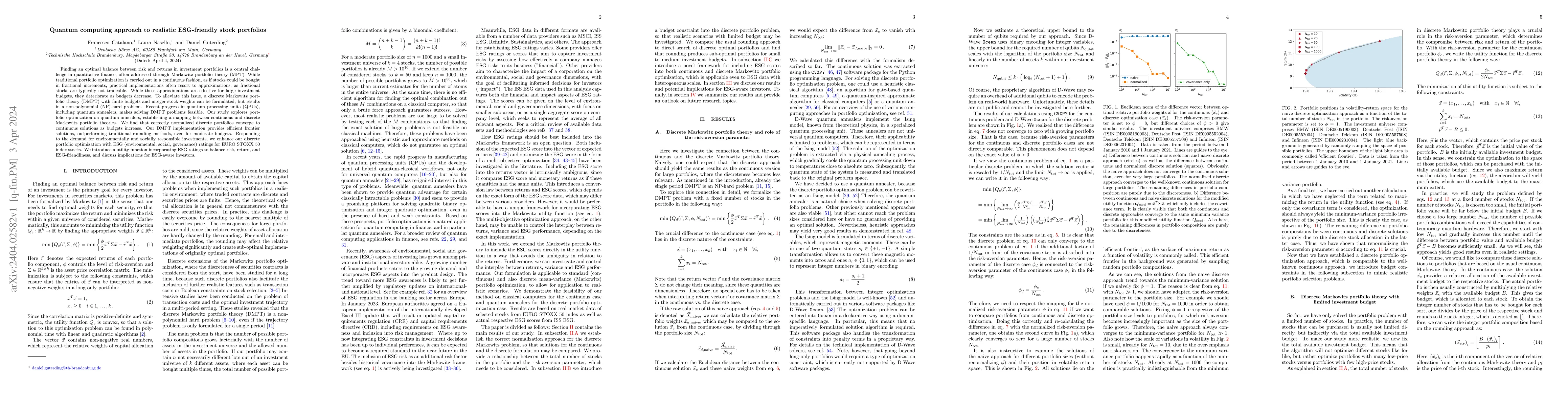

Finding an optimal balance between risk and returns in investment portfolios is a central challenge in quantitative finance, often addressed through Markowitz portfolio theory (MPT). While traditional portfolio optimization is carried out in a continuous fashion, as if stocks could be bought in fractional increments, practical implementations often resort to approximations, as fractional stocks are typically not tradeable. While these approximations are effective for large investment budgets, they deteriorate as budgets decrease. To alleviate this issue, a discrete Markowitz portfolio theory (DMPT) with finite budgets and integer stock weights can be formulated, but results in a non-polynomial (NP)-hard problem. Recent progress in quantum processing units (QPUs), including quantum annealers, makes solving DMPT problems feasible. Our study explores portfolio optimization on quantum annealers, establishing a mapping between continuous and discrete Markowitz portfolio theories. We find that correctly normalized discrete portfolios converge to continuous solutions as budgets increase. Our DMPT implementation provides efficient frontier solutions, outperforming traditional rounding methods, even for moderate budgets. Responding to the demand for environmentally and socially responsible investments, we enhance our discrete portfolio optimization with ESG (environmental, social, governance) ratings for EURO STOXX 50 index stocks. We introduce a utility function incorporating ESG ratings to balance risk, return, and ESG-friendliness, and discuss implications for ESG-aware investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWinners vs. Losers: Momentum-based Strategies with Intertemporal Choice for ESG Portfolios

Svetlozar T. Rachev, Frank J. Fabozzi, Abootaleb Shirvani et al.

Heterogeneity of household stock portfolios in a national market

Jyrki Piilo, Rosario N. Mantegna, Federico Musciotto et al.

Sentiment Analysis of ESG disclosures on Stock Market

Sudeep R. Bapat, Saumya Kothari, Rushil Bansal

| Title | Authors | Year | Actions |

|---|

Comments (0)