Summary

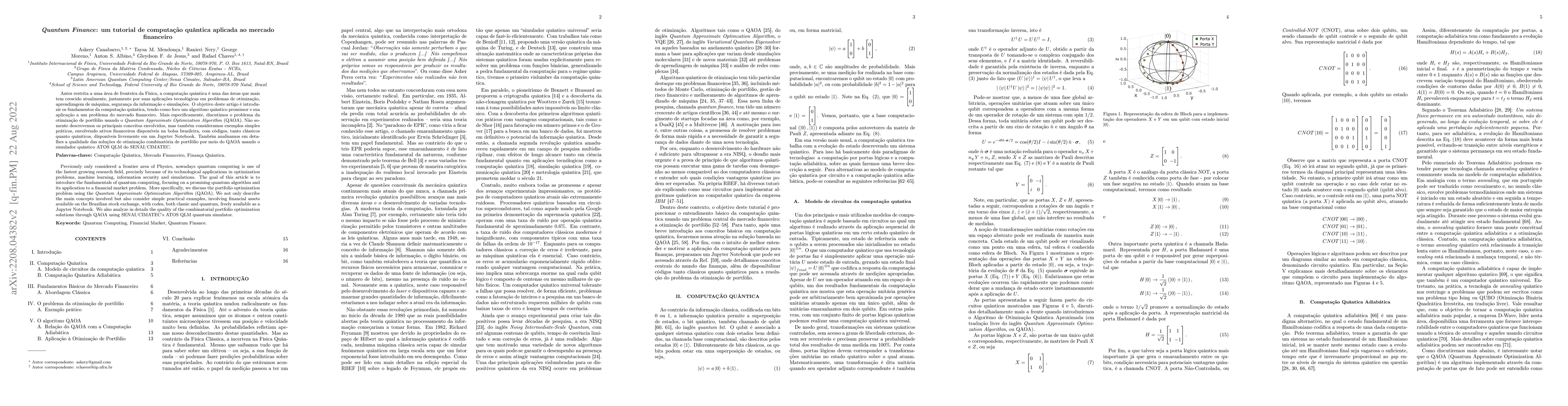

Previously only considered a frontier area of Physics, nowadays quantum computing is one of the fastest growing research field, precisely because of its technological applications in optimization problems, machine learning, information security and simulations. The goal of this article is to introduce the fundamentals of quantum computing, focusing on a promising quantum algorithm and its application to a financial market problem. More specifically, we discuss the portfolio optimization problem using the \textit{Quantum Approximate Optimization Algorithm} (QAOA). We not only describe the main concepts involved but also consider simple practical examples, involving financial assets available on the Brazilian stock exchange, with codes, both classic and quantum, freely available as a Jupyter Notebook. We also analyze in details the quality of the combinatorial portfolio optimization solutions through QAOA using SENAI/CIMATEC's ATOS QLM quantum simulator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Survey of Quantum Computing for Finance

Xiaoyuan Liu, Yuri Alexeev, Yue Sun et al.

A Structured Survey of Quantum Computing for the Financial Industry

Esther Hänggi, Thomas Ankenbrand, Stefan Stettler et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)