Summary

Quantum generative adversarial networks (QGANs) have been investigated as a method for generating synthetic data with the goal of augmenting training data sets for neural networks. This is especially relevant for financial time series, since we only ever observe one realization of the process, namely the historical evolution of the market, which is further limited by data availability and the age of the market. However, for classical generative adversarial networks it has been shown that generated data may (often) not exhibit desired properties (also called stylized facts), such as matching a certain distribution or showing specific temporal correlations. Here, we investigate whether quantum correlations in quantum inspired models of QGANs can help in the generation of financial time series. We train QGANs, composed of a quantum generator and a classical discriminator, and investigate two approaches for simulating the quantum generator: a full simulation of the quantum circuits, and an approximate simulation using tensor network methods. We tested how the choice of hyperparameters, such as the circuit depth and bond dimensions, influenced the quality of the generated time series. The QGAN that we trained generate synthetic financial time series that not only match the target distribution but also exhibit the desired temporal correlations, with the quality of each property depending on the hyperparameters and simulation method.

AI Key Findings

Generated Jul 31, 2025

Methodology

The research investigates Quantum Generative Adversarial Networks (QGANs) for generating synthetic financial time series with temporal correlations using quantum-inspired models. It compares two approaches for simulating the quantum generator: full simulation of quantum circuits and approximate simulation using tensor network methods.

Key Results

- QGANs successfully generate synthetic financial time series that match the target distribution.

- Generated time series exhibit desired temporal correlations, with the quality of each property dependent on hyperparameters and simulation method.

- MPS simulations allow for the training of QGANs with larger numbers of layers and qubits, which would be infeasible with full-state simulations.

- Generated time series reproduce stylized facts of financial time series, such as distribution, absence of linear autocorrelation, volatility clustering, and a weaker leverage effect compared to the S&P500 index.

Significance

This research is significant as it explores the use of quantum architectures to generate synthetic financial time series, which are notoriously challenging for classical models. The findings motivate further studies on quantum hardware's capability to generate financial time series with stylized facts.

Technical Contribution

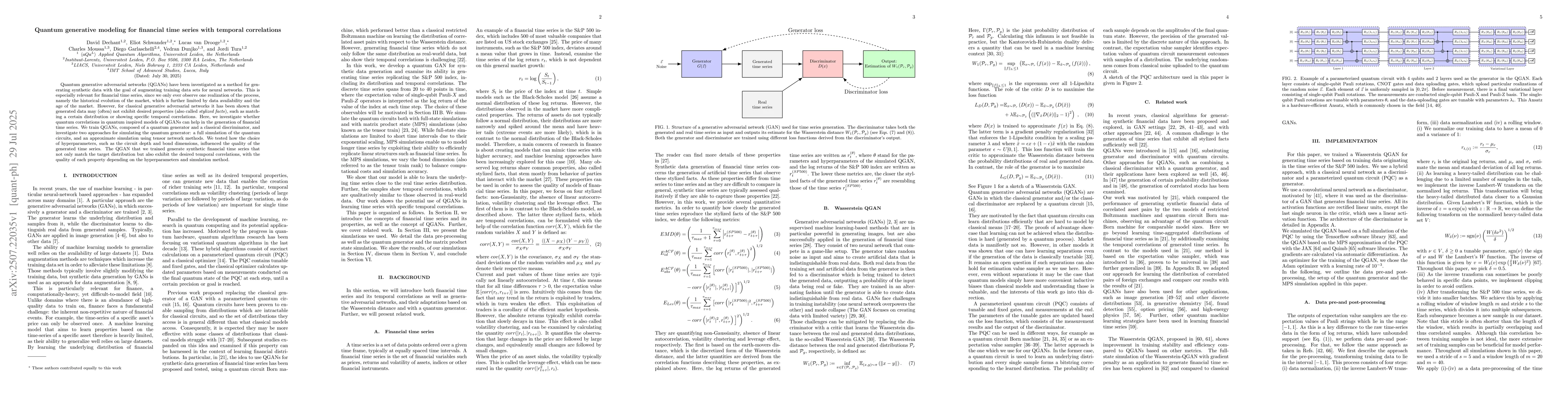

The paper introduces a Wasserstein QGAN with a classical convolutional network as a discriminator and an expectation value sampler based on a parameterized quantum circuit (PQC) as a generator.

Novelty

This work stands out by leveraging quantum architectures to capture temporal correlations in financial time series and training a QGAN with a PQC simulated using matrix product states (MPS), enabling the generation of longer time series than feasible with full-state simulations.

Limitations

- The study is limited by computational resources, as full-state simulations become infeasible with higher numbers of layers and qubits.

- The quality of generated time series can vary depending on hyperparameters and simulation methods.

Future Work

- Explore the impact of generated data on the training of neural networks for financial applications.

- Investigate the replication of correlated stock time series within the S&P500 index using quantum generators.

- Study the potential of quantum generators consisting of circuits on qudits for more independent measurements.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplication of time-series quantum generative model to financial data

Shun Okumura, Masayuki Ohzeki, Masaya Abe

Deep Generative Modeling for Financial Time Series with Application in VaR: A Comparative Review

Shuang Li, Ping Hu, Rao Fu et al.

Generative model for financial time series trained with MMD using a signature kernel

Julian Sester, Chung I Lu

No citations found for this paper.

Comments (0)