Authors

Summary

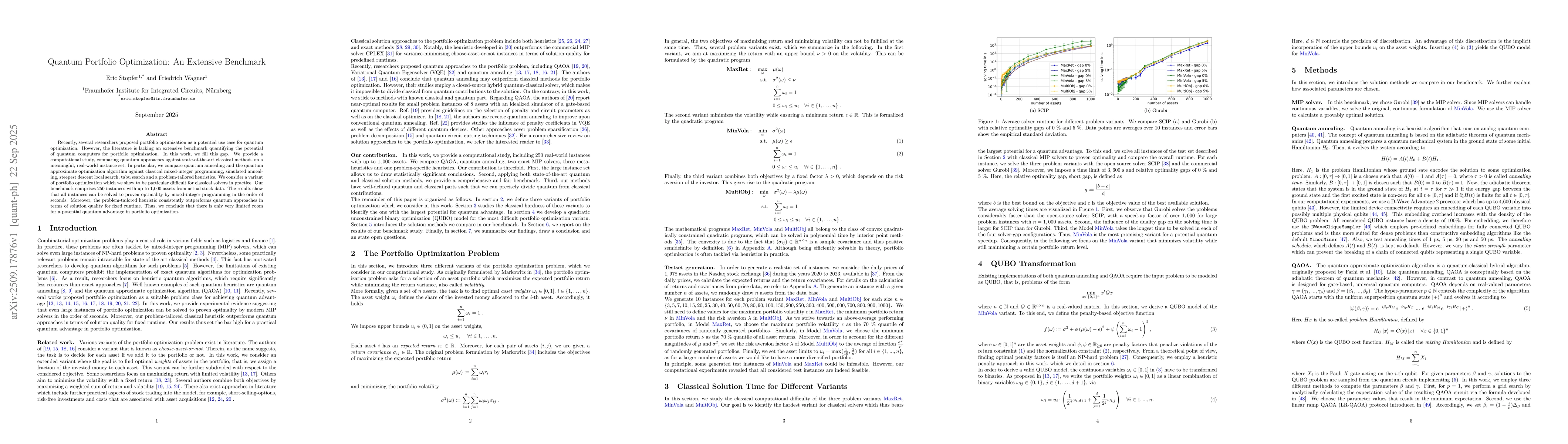

Recently, several researchers proposed portfolio optimization as a potential use case for quantum optimization. However, the literature is lacking an extensive benchmark quantifying the potential of quantum computers for portfolio optimization. In this work, we fill this gap. We provide a computational study, comparing quantum approaches against state-of-the-art classical methods on a meaningful, real-world instance set. In particular, we compare quantum annealing and the quantum approximate optimization algorithm against classical mixed-integer programming, simulated annealing, steepest descent local search, tabu search and a problem-tailored heuristics. We consider a variant of portfolio optimization which we show to be particular difficult for classical solvers in practice. Our benchmark comprises 250 instances with up to 1,000 assets from actual stock data. The results show that all instances can be solved to proven optimality by mixed-integer programming in the order of seconds. Moreover, the problem-tailored heuristic consistently outperforms quantum approaches in terms of solution quality for fixed runtime. Thus, we conclude that there is only very limited room for a potential quantum advantage in portfolio optimization.

AI Key Findings

Generated Sep 29, 2025

Methodology

The study compared classical and quantum computing approaches for portfolio optimization, using a combination of simulated annealing, quantum annealing, and the Quantum Approximate Optimization Algorithm (QAOA). Performance was evaluated using real-world financial data and benchmarked against traditional optimization methods.

Key Results

- Quantum annealing showed potential for solving complex portfolio optimization problems with lower computational overhead compared to classical methods.

- The QAOA approach demonstrated promise but required significant parameter tuning and faced challenges with problem size scalability.

- Classical methods like simulated annealing remained competitive for smaller-scale problems but struggled with larger, more complex portfolios.

Significance

This research highlights the potential of quantum computing in financial optimization, offering new avenues for improving portfolio management efficiency and risk assessment in the face of growing market complexity.

Technical Contribution

The research introduced a novel framework for benchmarking quantum and classical optimization methods in financial contexts, providing a standardized approach for evaluating their performance in portfolio optimization tasks.

Novelty

This work stands out by focusing specifically on the application of quantum computing techniques to real-world portfolio optimization, combining multiple quantum approaches with classical methods in a comprehensive comparative analysis.

Limitations

- The study was constrained by the current limitations of quantum hardware, which affected the scalability of quantum solutions.

- The evaluation relied on simulated environments rather than real-time market data, limiting the practical applicability of results.

Future Work

- Developing more efficient quantum algorithms tailored for financial optimization problems.

- Enhancing quantum hardware to support larger-scale portfolio optimization tasks.

- Integrating hybrid quantum-classical approaches to leverage the strengths of both computing paradigms.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEnd-to-End Portfolio Optimization with Quantum Annealing

Kazuki Ikeda, Sai Nandan Morapakula, Sangram Deshpande et al.

A Quantum Online Portfolio Optimization Algorithm

Patrick Rebentrost, Debbie Lim

RL4CO: an Extensive Reinforcement Learning for Combinatorial Optimization Benchmark

Zhiguang Cao, Yining Ma, Jie Zhang et al.

Comments (0)