Summary

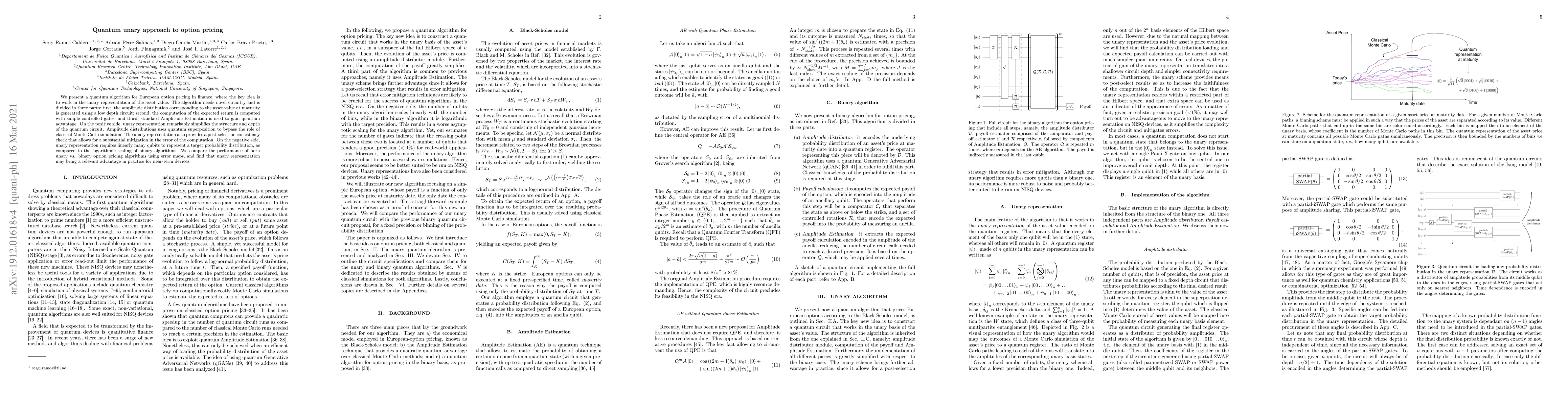

We present a quantum algorithm for European option pricing in finance, where the key idea is to work in the unary representation of the asset value. The algorithm needs novel circuitry and is divided in three parts: first, the amplitude distribution corresponding to the asset value at maturity is generated using a low depth circuit; second, the computation of the expected return is computed with simple controlled gates; and third, standard Amplitude Estimation is used to gain quantum advantage. On the positive side, unary representation remarkably simplifies the structure and depth of the quantum circuit. Amplitude distributions uses quantum superposition to bypass the role of classical Monte Carlo simulation. The unary representation also provides a post-selection consistency check that allows for a substantial mitigation in the error of the computation. On the negative side, unary representation requires linearly many qubits to represent a target probability distribution, as compared to the logarithmic scaling of binary algorithms. We compare the performance of both unary vs. binary option pricing algorithms using error maps, and find that unary representation may bring a relevant advantage in practice for near-term devices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Hamiltonian Approach to Floating Barrier Option Pricing

Qi Chen, Chao Guo, Hong-tao Wang

Efficient option pricing with unary-based photonic computing chip and generative adversarial learning

Feng Gao, Hui Zhang, Hong Cai et al.

A Hamiltonian Approach to Barrier Option Pricing Under Vasicek Model

Chao Guo, Qi Chen Hong-tao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)