Authors

Summary

We prove the existence of a Radner equilibrium in a model with population growth and analyze the effects on asset prices. A finite population of agents grows indefinitely at a Poisson rate, while receiving unspanned income and choosing between consumption and investing into an annuity with infinitely-lived exponential preferences. After establishing the existence of an equilibrium for a truncated number of agents, we prove that an equilibrium exists for the model with unlimited population growth. Our numerics show that increasing the birth rate reduces oscillations in the equilibrium annuity price, and when younger agents prioritize the present more than older agents, the equilibrium annuity price rises compared to a uniform demographic.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper proves the existence of a Radner equilibrium in a model with population growth, analyzing effects on asset prices. It establishes equilibrium existence for a truncated number of agents and extends it to unlimited population growth, using recursive equations and diagonalization arguments.

Key Results

- Existence of Radner equilibrium with population growth is proven.

- Annuity price equilibrium constructed given a solution to the recursive system.

- Numerical analysis shows that increasing birth rate reduces oscillations in equilibrium annuity price.

- When younger agents prioritize present more, equilibrium annuity price rises compared to a uniform demographic.

Significance

This research contributes to understanding dynamic equilibrium in economies with heterogeneous agents and incomplete markets, providing insights into asset pricing and population growth effects.

Technical Contribution

The paper develops a theoretical framework for proving equilibrium existence in models with population growth, using recursive equations and diagonalization techniques.

Novelty

The work extends existing Radner equilibrium theory to incorporate population growth, providing new insights into the dynamics of asset prices in growing economies.

Limitations

- Assumptions on constant birth rate and specific agent preferences may limit generalizability.

- Model does not account for all possible market frictions or complex financial instruments.

Future Work

- Explore the impact of non-constant birth rates and more complex demographic structures.

- Investigate the effects of additional market frictions and diverse financial instruments.

Paper Details

PDF Preview

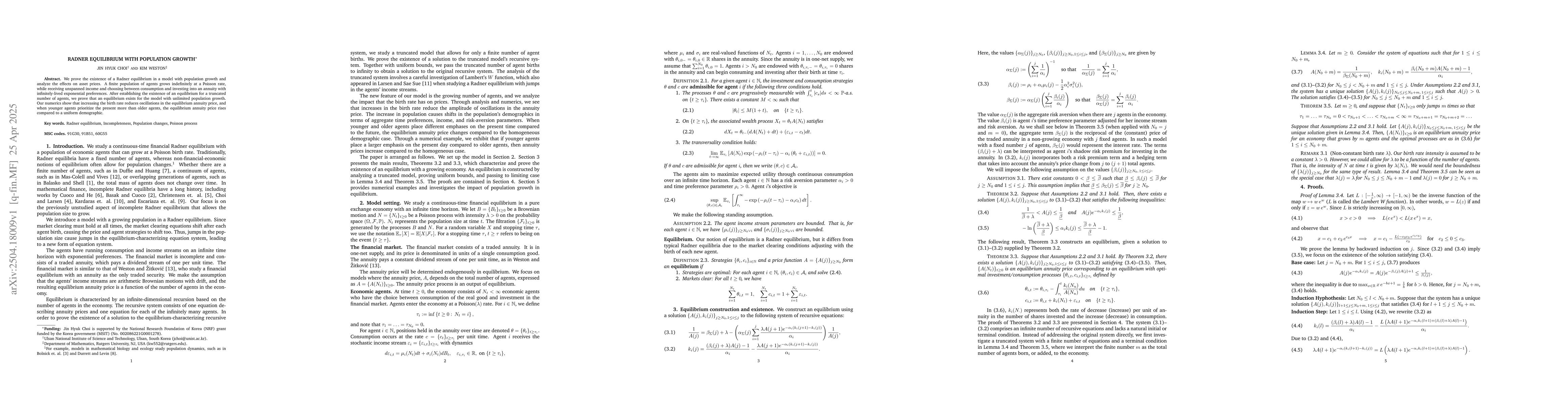

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResolving a Clearing Member's Default, A Radner Equilibrium Approach

Stéphane Crépey, Dorinel Bastide, Samuel Drapeau et al.

No citations found for this paper.

Comments (0)