Authors

Summary

We study optimal execution in markets with transient price impact in a competitive setting with $N$ traders. Motivated by prior negative results on the existence of pure Nash equilibria, we consider randomized strategies for the traders and whether allowing such strategies can restore the existence of equilibria. We show that given a randomized strategy, there is a non-randomized strategy with strictly lower expected execution cost, and moreover this de-randomization can be achieved by a simple averaging procedure. As a consequence, Nash equilibria cannot contain randomized strategies, and non-existence of pure equilibria implies non-existence of randomized equilibria. Separately, we also establish uniqueness of equilibria. Both results hold in a general transaction cost model given by a strictly positive definite impact decay kernel and a convex trading cost.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper studies optimal execution in markets with transient price impact in a competitive setting with N traders, considering both randomized and non-randomized strategies.

Key Results

- Non-randomized strategies have strictly lower expected execution costs compared to randomized strategies.

- Nash equilibria cannot contain randomized strategies, and non-existence of pure equilibria implies non-existence of randomized equilibria.

- Uniqueness of equilibria is established under a general transaction cost model with a strictly positive definite impact decay kernel and a convex trading cost.

Significance

This research contributes to understanding optimal execution strategies in competitive markets, providing insights into the effectiveness of randomized vs. non-randomized strategies and the non-existence of mixed-strategy equilibria.

Technical Contribution

The paper demonstrates that de-randomization can be achieved via a simple averaging procedure, leading to the non-existence of randomized equilibria in optimal execution games.

Novelty

This work extends prior negative results on the existence of pure Nash equilibria by considering randomized strategies, revealing that non-existence of pure equilibria also implies non-existence of randomized equilibria.

Limitations

- The study focuses on a competitive setting with N traders, which may not fully capture real-world complexities in trading environments.

- The model assumes a strictly positive definite impact decay kernel and convex trading costs, which might not always hold in empirical settings.

Future Work

- Investigate the impact of market microstructure features not covered in the current model, such as order book dynamics and market makers.

- Explore the implications of the findings for more complex trading environments, including those with asymmetric information or strategic interactions.

Paper Details

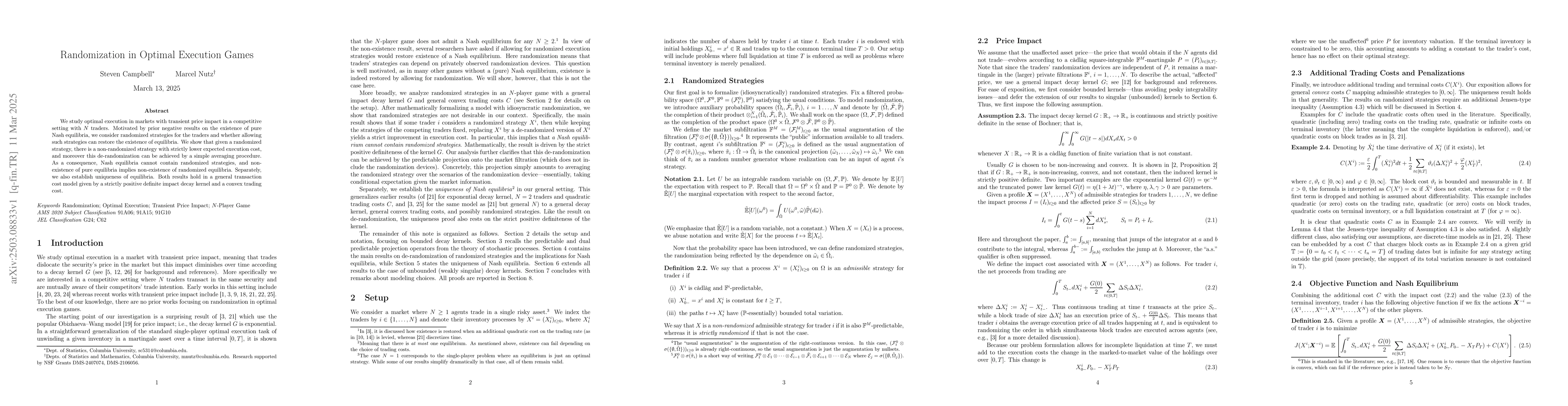

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimulator-Free Visual Domain Randomization via Video Games

Antonios Liapis, Georgios N. Yannakakis, Chintan Trivedi et al.

No citations found for this paper.

Comments (0)