Authors

Summary

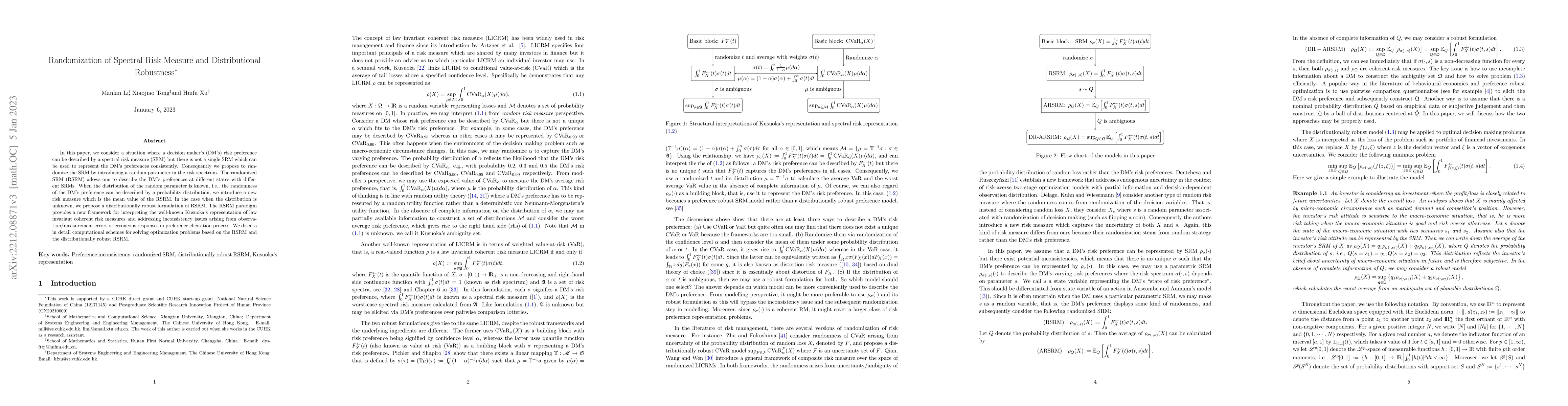

In this paper, we consider a situation where a decision maker's (DM's) risk preference can be described by a spectral risk measure (SRM) but there is not a single SRM which can be used to represent the DM's preferences consistently. Consequently we propose to randomize the SRM by introducing a random parameter in the risk spectrum. The randomized SRM (RSRM) allows one to describe the DM's preferences at different states with different SRMs. When the distribution of the random parameter is known, i.e., the randomness of the DM's preference can be described by a probability distribution, we introduce a new risk measure which is the mean value of the RSRM. In the case when the distribution is unknown, we propose a distributionally robust formulation of RSRM. The RSRM paradigm provides a new framework for interpreting the well-known Kusuoka's representation of law invariant coherent risk measures and addressing inconsistency issues arising from observation/measurement errors or erroneous responses in preference elicitation process. We discuss in detail computational schemes for solving optimization problems based on the RSRM and the distributionally robust RSRM.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributional Robustness Bounds Generalization Errors

Haowei Wang, Shixiong Wang

Robustness and risk management via distributional dynamic programming

Gergely Neu, Mastane Achab

| Title | Authors | Year | Actions |

|---|

Comments (0)