Authors

Summary

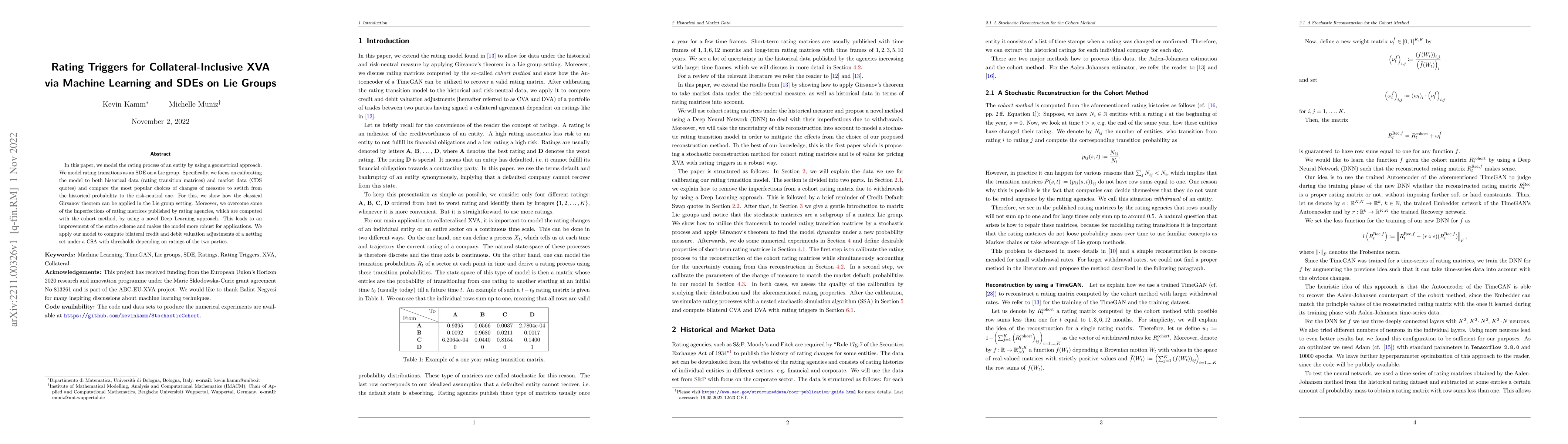

In this paper, we model the rating process of an entity by using a geometrical approach. We model rating transitions as an SDE on a Lie group. Specifically, we focus on calibrating the model to both historical data (rating transition matrices) and market data (CDS quotes) and compare the most popular choices of changes of measure to switch from the historical probability to the risk-neutral one. For this, we show how the classical Girsanov theorem can be applied in the Lie group setting. Moreover, we overcome some of the imperfections of rating matrices published by rating agencies, which are computed with the cohort method, by using a novel Deep Learning approach. This leads to an improvement of the entire scheme and makes the model more robust for applications. We apply our model to compute bilateral credit and debit valuation adjustments of a netting set under a CSA with thresholds depending on ratings of the two parties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA novel approach to rating transition modelling via Machine Learning and SDEs on Lie groups

Kevin Kamm, Michelle Muniz

Computing XVA for American basket derivatives by Machine Learning techniques

Andrea Molent, Antonino Zanette, Ludovic Goudenege

| Title | Authors | Year | Actions |

|---|

Comments (0)