Summary

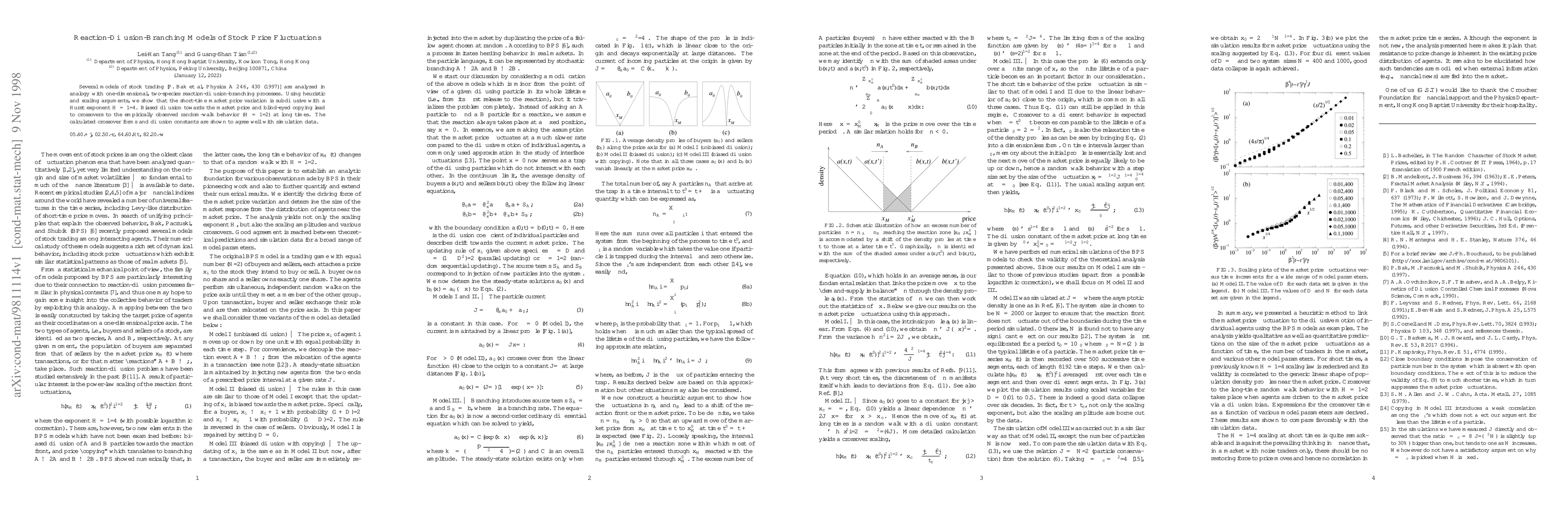

Several models of stock trading [P. Bak et al, Physica A {\bf 246}, 430 (1997)] are analyzed in analogy with one-dimensional, two-species reaction-diffusion-branching processes. Using heuristic and scaling arguments, we show that the short-time market price variation is subdiffusive with a Hurst exponent $H=1/4$. Biased diffusion towards the market price and blind-eyed copying lead to crossovers to the empirically observed random-walk behavior ($H=1/2$) at long times. The calculated crossover forms and diffusion constants are shown to agree well with simulation data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)