Authors

Summary

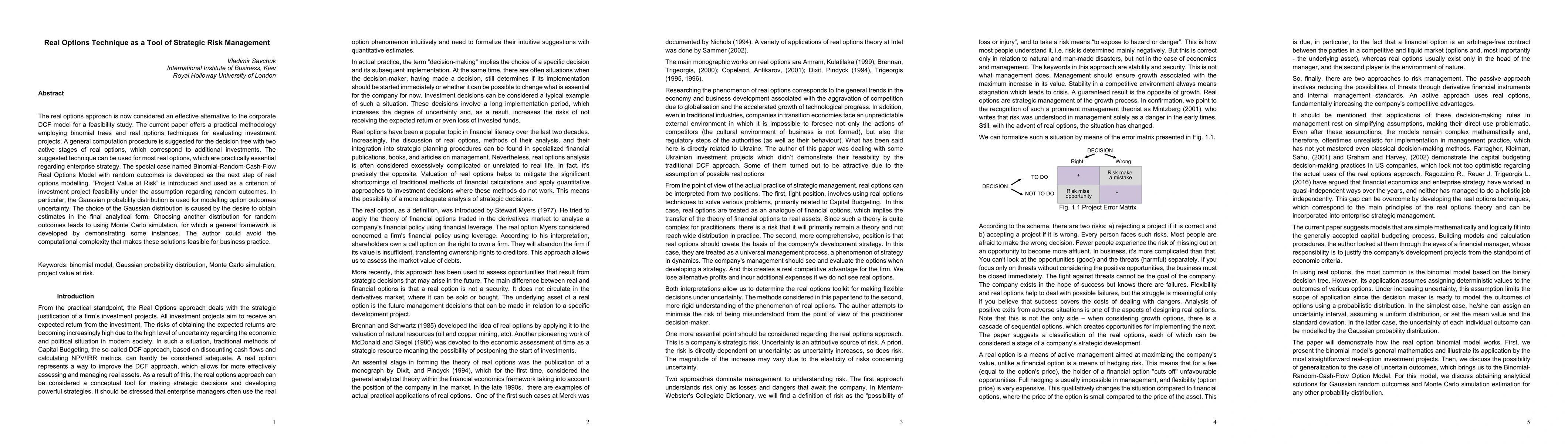

The real options approach is now considered an effective alternative to the corporate DCF model for a feasibility study. The current paper offers a practical methodology employing binomial trees and real options techniques for evaluating investment projects. A general computation procedure is suggested for the decision tree with two active stages of real options, which correspond to additional investments. The suggested technique can be used for most real options, which are practically essential regarding enterprise strategy. The special case named Binomial-Random-Cash-Flow Real Options Model with random outcomes is developed as the next step of real options modelling. Project Value at Risk is introduced and used as a criterion of investment project feasibility under the assumption regarding random outcomes. In particular, the Gaussian probability distribution is used for modelling option outcomes uncertainty. The choice of the Gaussian distribution is caused by the desire to obtain estimates in the final analytical form. Choosing another distribution for random outcomes leads to using Monte Carlo simulation, for which a general framework is developed by demonstrating some instances. The author could avoid the computational complexity that makes these solutions feasible for business practice.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeltaHedge: A Multi-Agent Framework for Portfolio Options Optimization

Jarosław A. Chudziak, Feliks Bańka

No citations found for this paper.

Comments (0)