Summary

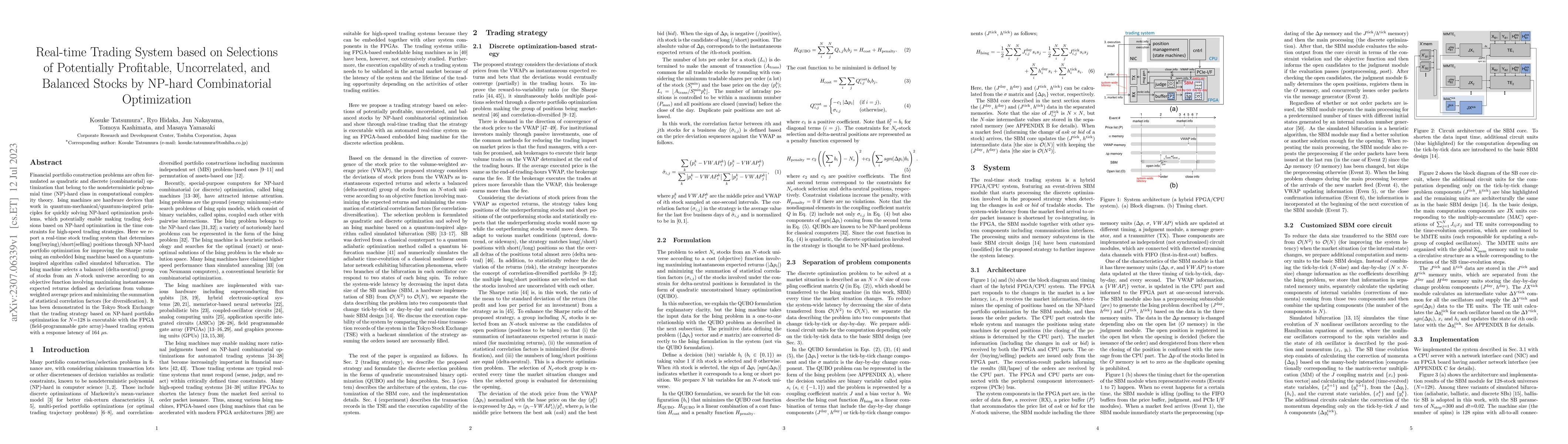

Financial portfolio construction problems are often formulated as quadratic and discrete (combinatorial) optimization that belong to the nondeterministic polynomial time (NP)-hard class in computational complexity theory. Ising machines are hardware devices that work in quantum-mechanical/quantum-inspired principles for quickly solving NP-hard optimization problems, which potentially enable making trading decisions based on NP-hard optimization in the time constraints for high-speed trading strategies. Here we report a real-time stock trading system that determines long(buying)/short(selling) positions through NP-hard portfolio optimization for improving the Sharpe ratio using an embedded Ising machine based on a quantum-inspired algorithm called simulated bifurcation. The Ising machine selects a balanced (delta-neutral) group of stocks from an $N$-stock universe according to an objective function involving maximizing instantaneous expected returns defined as deviations from volume-weighted average prices and minimizing the summation of statistical correlation factors (for diversification). It has been demonstrated in the Tokyo Stock Exchange that the trading strategy based on NP-hard portfolio optimization for $N$=128 is executable with the FPGA (field-programmable gate array)-based trading system with a response latency of 164 $\mu$s.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPairs-trading System using Quantum-inspired Combinatorial Optimization Accelerator for Optimal Path Search in Market Graphs

Tomoya Kashimata, Masaya Yamasaki, Ryo Hidaka et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)