Summary

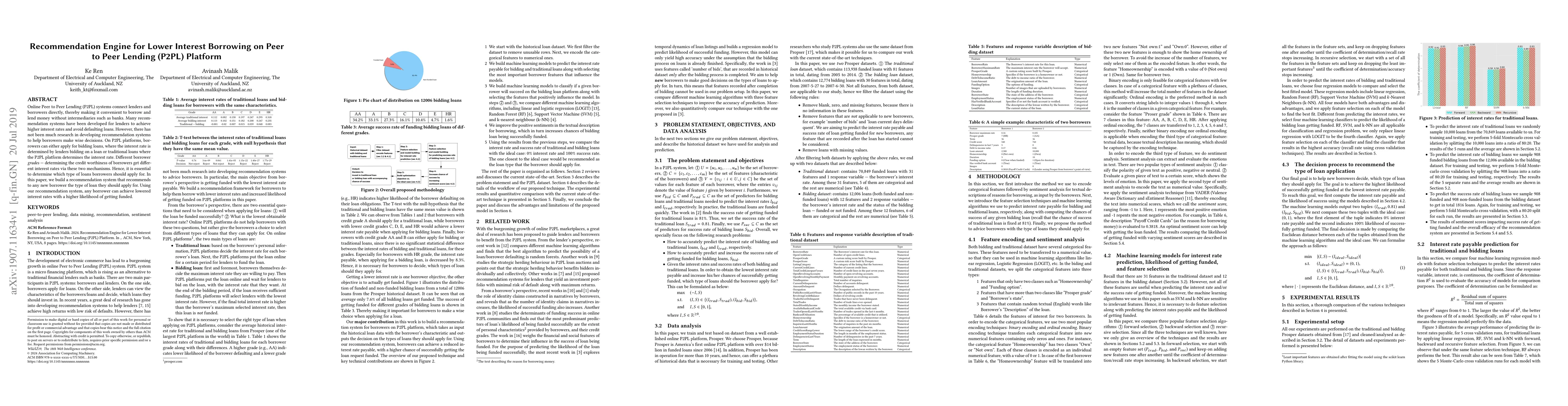

Online Peer to Peer Lending (P2PL) systems connect lenders and borrowers directly, thereby making it convenient to borrow and lend money without intermediaries such as banks. Many recommendation systems have been developed for lenders to achieve higher interest rates and avoid defaulting loans. However, there has not been much research in developing recommendation systems to help borrowers make wise decisions. On P2PL platforms, borrowers can either apply for bidding loans, where the interest rate is determined by lenders bidding on a loan or traditional loans where the P2PL platform determines the interest rate. Different borrower grades -- determining the credit worthiness of borrowers get different interest rates via these two mechanisms. Hence, it is essential to determine which type of loans borrowers should apply for. In this paper, we build a recommendation system that recommends to any new borrower the type of loan they should apply for. Using our recommendation system, any borrower can achieve lowered interest rates with a higher likelihood of getting funded.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)