Summary

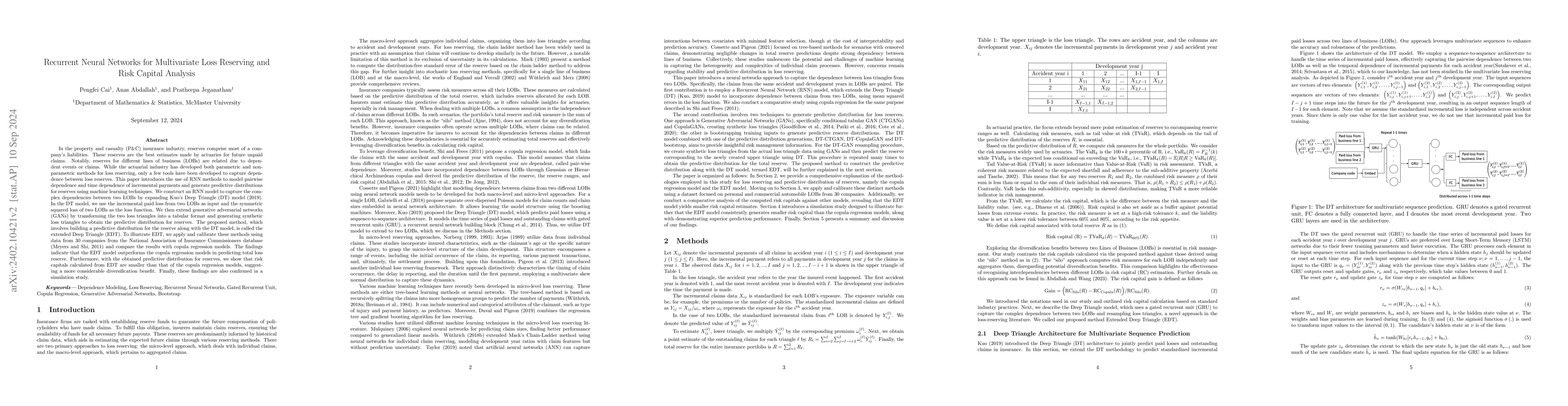

Reserves comprise most of the liabilities of a property and casualty (P&C) company and are actuaries' best estimate for unpaid future claims. Notably, the reserves for different lines of business (LOB) are related, as there may be dependence between events related to claims. There have been parametric and non-parametric methods in the actuarial industry for loss reserving; only a few tools have been developed to use the recurrent neural network (RNN) for multivariate loss reserving and risk capital analyses. This paper aims to study RNN methods to model dependence between loss triangles and develop predictive distribution for reserves using machine learning. Thus, we create an RNN model to capture dependence between LOBs by extending the Deep Triangle (DT) model from Kuo (2019). In the extended Deep Triangle (EDT), we use the incremental paid loss from two LOBs as input and the symmetric squared loss of two LOBs as the loss function. Then, we extend generative adversarial networks (GANs) by transforming the two loss triangles into a tabular format and generating synthetic loss triangles to obtain the predictive distribution for reserves. To illustrate our method, we apply and calibrate these methods on personal and commercial automobile lines from a large US P&C insurance company and compare the results with copula regression models. The results show that the EDT model performs better than the copula regression models in predicting total loss reserve. In addition, with the obtained predictive distribution for reserves, we show that risk capitals calculated from EDT combined with GAN are smaller than that of the copula regression models, which implies a more considerable diversification benefit. Finally, these findings are also confirmed in a simulation study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic loss reserving with mixture density neural networks

Benjamin Avanzi, Greg Taylor, Bernard Wong et al.

Generalization and Risk Bounds for Recurrent Neural Networks

Ke Huang, Shujie Ma, Xuewei Cheng

Detection and treatment of outliers for multivariate robust loss reserving

Benjamin Avanzi, Greg Taylor, Bernard Wong et al.

No citations found for this paper.

Comments (0)