Summary

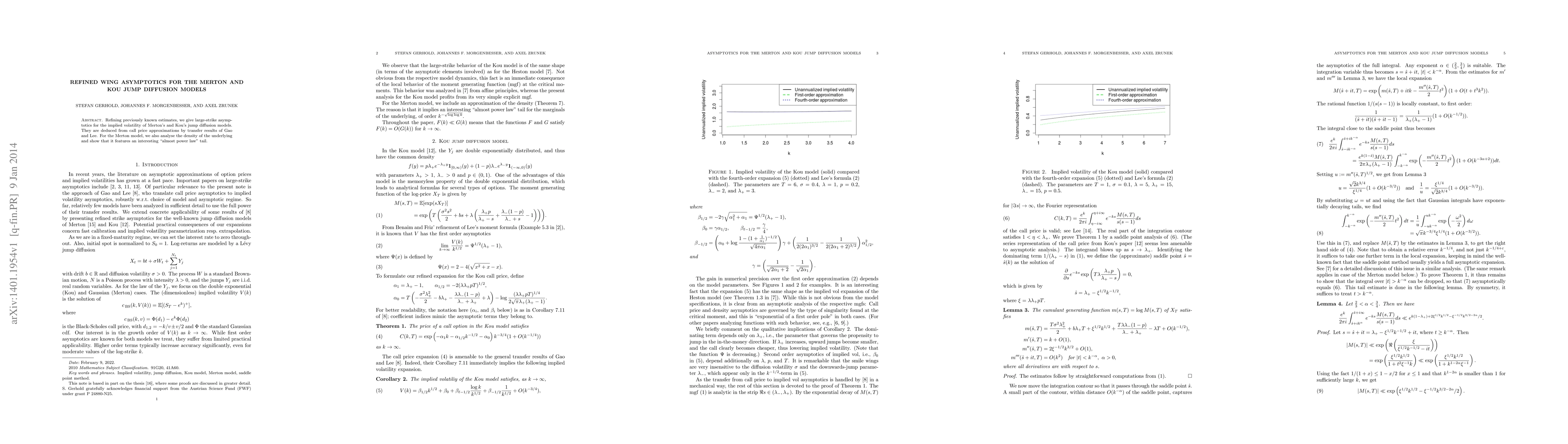

Refining previously known estimates, we give large-strike asymptotics for the implied volatility of Merton's and Kou's jump diffusion models. They are deduced from call price approximations by transfer results of Gao and Lee. For the Merton model, we also analyse the density of the underlying and show that it features an interesting "almost power law" tail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsymptotics for Short Maturity Asian Options in Jump-Diffusion models with Local Volatility

Dan Pirjol, Lingjiong Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)