Summary

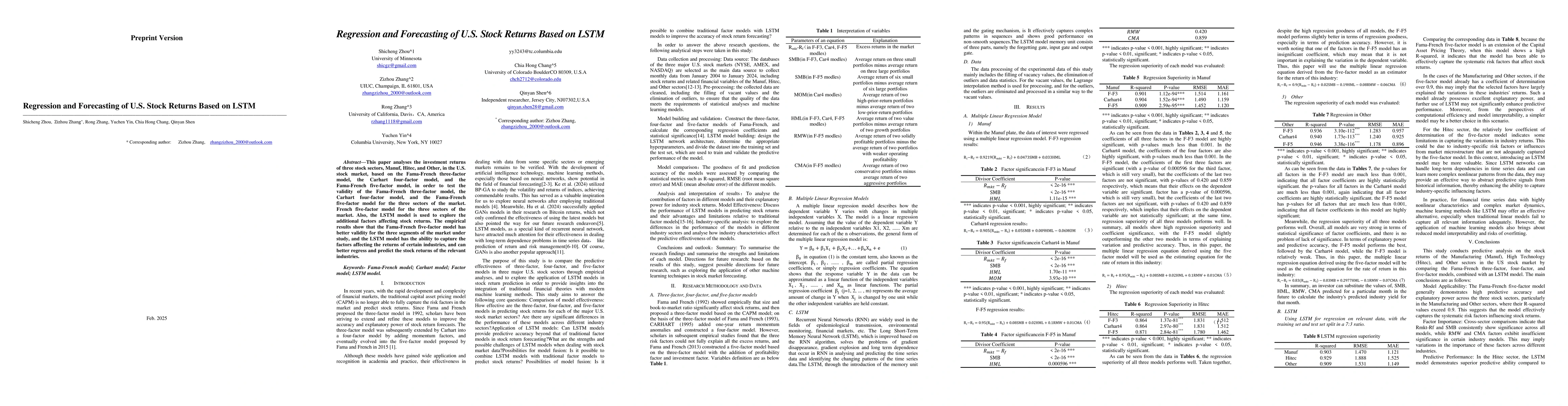

This paper analyses the investment returns of three stock sectors, Manuf, Hitec, and Other, in the U.S. stock market, based on the Fama-French three-factor model, the Carhart four-factor model, and the Fama-French five-factor model, in order to test the validity of the Fama-French three-factor model, the Carhart four-factor model, and the Fama-French five-factor model for the three sectors of the market. French five-factor model for the three sectors of the market. Also, the LSTM model is used to explore the additional factors affecting stock returns. The empirical results show that the Fama-French five-factor model has better validity for the three segments of the market under study, and the LSTM model has the ability to capture the factors affecting the returns of certain industries, and can better regress and predict the stock returns of the relevant industries. Keywords- Fama-French model; Carhart model; Factor model; LSTM model.

AI Key Findings

Generated Jun 12, 2025

Methodology

The study applies multiple linear regression models (Fama-French three-factor, Carhart four-factor, and Fama-French five-factor models) to analyze U.S. stock returns across Manufacturing (Manuf), High Technology (Hitec), and Other sectors. LSTM (Long Short-Term Memory) neural networks are also used to explore additional factors affecting stock returns.

Key Results

- The Fama-French five-factor model shows better validity for the three sectors of the market under study.

- LSTM model effectively captures factors influencing returns of certain industries, offering better regression and prediction of stock returns in relevant industries.

- In the Hitec sector, LSTM model demonstrates superior predictive ability compared to traditional factor models.

- For the Manuf and Other sectors, the five-factor model already has a high coefficient of determination, indicating that selected factors largely explain variations in their returns, and further use of LSTM might not significantly enhance predictive performance.

Significance

This research is significant as it validates the Fama-French five-factor model's applicability for predicting stock returns in various sectors, especially Manufacturing and Other sectors, and highlights the potential of LSTM models in handling complex market dynamics and non-linear characteristics in financial time series data.

Technical Contribution

The paper demonstrates the effectiveness of LSTM models in capturing complex patterns in time-series financial data and improving predictive accuracy, particularly in sectors with less explanatory power from traditional factor models.

Novelty

This research stands out by combining traditional factor models with LSTM neural networks to enhance stock return predictions, providing a novel approach to financial market analysis.

Limitations

- The study does not extensively explore the application of LSTM in Manuf and Other sectors due to their high explanatory power from the five-factor model.

- The paper does not delve into the interpretability and risks of overfitting associated with LSTM models.

Future Work

- Investigating the application of other machine learning algorithms, like Convolutional Neural Networks (CNN) and attention mechanisms, for stock market prediction.

- Expanding the analysis to more industries or emerging markets to understand model performance under diverse market structures.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting Nigerian Equity Stock Returns Using Long Short-Term Memory Technique

Adebola K. Ojo, Ifechukwude Jude Okafor

1D-CapsNet-LSTM: A Deep Learning-Based Model for Multi-Step Stock Index Forecasting

Cheng Zhang, Nilam Nur Amir Sjarif, Roslina Ibrahim

Forecasting the Performance of US Stock Market Indices During COVID-19: RF vs LSTM

Ali Lashgari, Reza Nematirad, Amin Ahmadisharaf

No citations found for this paper.

Comments (0)