Summary

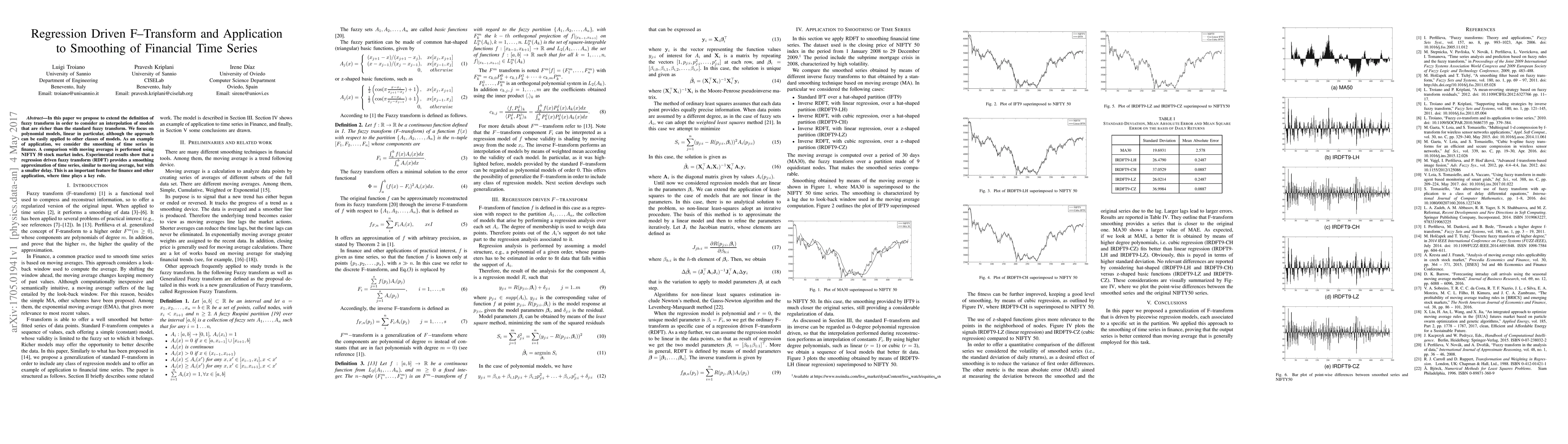

In this paper we propose to extend the definition of fuzzy transform in order to consider an interpolation of models that are richer than the standard fuzzy transform. We focus on polynomial models, linear in particular, although the approach can be easily applied to other classes of models. As an example of application, we consider the smoothing of time series in finance. A comparison with moving averages is performed using NIFTY 50 stock market index. Experimental results show that a regression driven fuzzy transform (RDFT) provides a smoothing approximation of time series, similar to moving average, but with a smaller delay. This is an important feature for finance and other application, where time plays a key role.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplication of time-series quantum generative model to financial data

Shun Okumura, Masayuki Ohzeki, Masaya Abe

A semi-parametric estimation method for quantile coherence with an application to bivariate financial time series clustering

Ying Sun, Cristian F. Jiménez-Varón, Ta-Hsin Li

| Title | Authors | Year | Actions |

|---|

Comments (0)