Authors

Summary

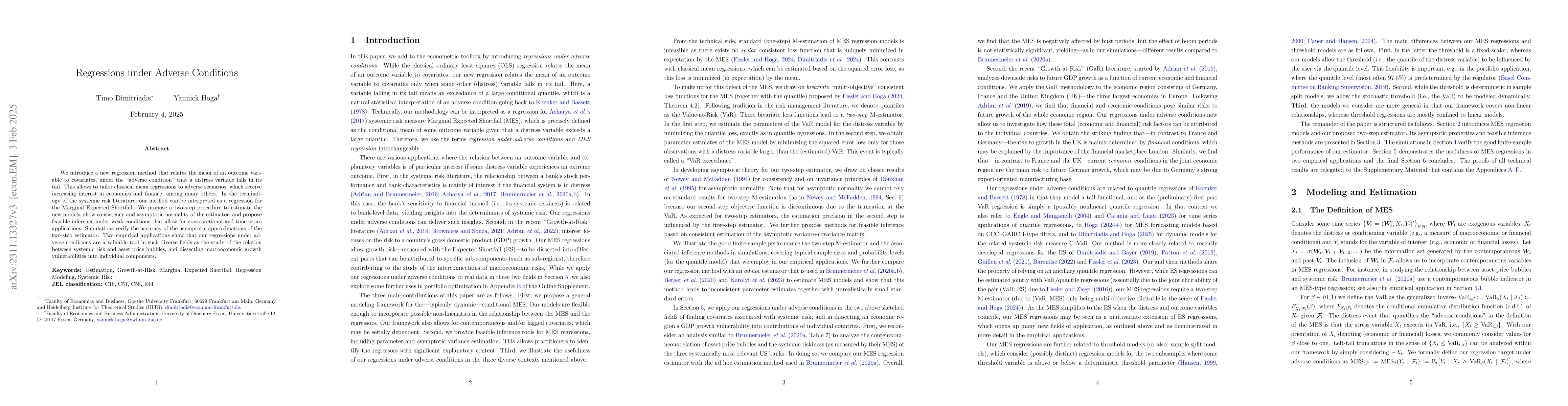

We introduce a new regression method that relates the mean of an outcome variable to covariates, given the "adverse condition" that a distress variable falls in its tail. This allows to tailor classical mean regressions to adverse economic scenarios, which receive increasing interest in managing macroeconomic and financial risks, among many others. In the terminology of the systemic risk literature, our method can be interpreted as a regression for the Marginal Expected Shortfall. We propose a two-step procedure to estimate the new models, show consistency and asymptotic normality of the estimator, and propose feasible inference under weak conditions allowing for cross-sectional and time series applications. The accuracy of the asymptotic approximations of the two-step estimator is verified in simulations. Two empirical applications show that our regressions under adverse conditions are valuable in such diverse fields as the study of the relation between systemic risk and asset price bubbles, and dissecting macroeconomic growth vulnerabilities into individual components.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersRoSe: Robust Self-supervised Stereo Matching under Adverse Weather Conditions

Junhui Hou, Chenghao Zhang, Yun Wang et al.

FREST: Feature RESToration for Semantic Segmentation under Multiple Adverse Conditions

Suha Kwak, Sohyun Lee, Namyup Kim et al.

Leveraging Synthetic Data to Learn Video Stabilization Under Adverse Conditions

Erickson R. Nascimento, Richard Jiang, Leandro Soriano Marcolino et al.

No citations found for this paper.

Comments (0)