Summary

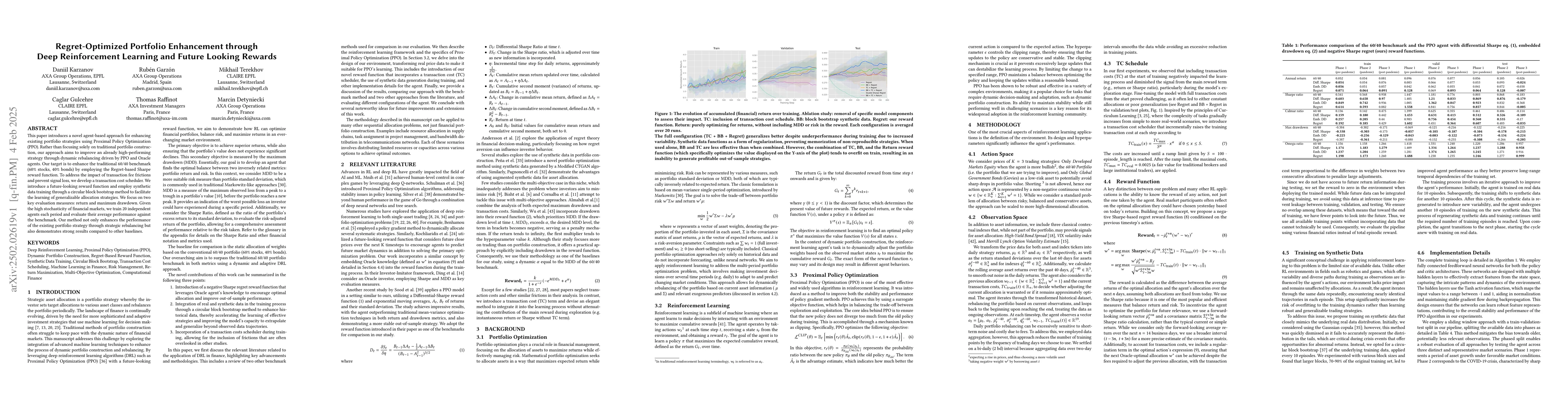

This paper introduces a novel agent-based approach for enhancing existing portfolio strategies using Proximal Policy Optimization (PPO). Rather than focusing solely on traditional portfolio construction, our approach aims to improve an already high-performing strategy through dynamic rebalancing driven by PPO and Oracle agents. Our target is to enhance the traditional 60/40 benchmark (60% stocks, 40% bonds) by employing the Regret-based Sharpe reward function. To address the impact of transaction fee frictions and prevent signal loss, we develop a transaction cost scheduler. We introduce a future-looking reward function and employ synthetic data training through a circular block bootstrap method to facilitate the learning of generalizable allocation strategies. We focus on two key evaluation measures: return and maximum drawdown. Given the high stochasticity of financial markets, we train 20 independent agents each period and evaluate their average performance against the benchmark. Our method not only enhances the performance of the existing portfolio strategy through strategic rebalancing but also demonstrates strong results compared to other baselines.

AI Key Findings

Generated Jun 12, 2025

Methodology

The research employs an agent-based approach using Proximal Policy Optimization (PPO) for dynamic rebalancing of portfolio strategies. It introduces a transaction cost scheduler, a future-looking reward function, and uses synthetic data training via circular block bootstrap method.

Key Results

- The method enhances the traditional 60/40 benchmark through strategic rebalancing.

- Demonstrates strong performance compared to other baselines.

Significance

This research is important as it aims to improve existing high-performing portfolio strategies by mitigating transaction fee frictions and signal loss, potentially leading to better financial market performance.

Technical Contribution

The development of a regret-based Sharpe reward function and a future-looking reward mechanism, along with a transaction cost scheduler, represents the main technical contributions.

Novelty

The novelty lies in combining deep reinforcement learning with a regret-based reward function and future-looking considerations for portfolio optimization, addressing transaction costs through a scheduler.

Limitations

- The paper does not discuss limitations explicitly, but high stochasticity in financial markets might affect generalizability.

- Reliance on synthetic data for training could introduce discrepancies with real-world market dynamics.

Future Work

- Exploration of additional financial instruments or asset classes beyond stocks and bonds.

- Investigating the impact of varying transaction cost structures on agent performance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMultimodal Deep Reinforcement Learning for Portfolio Optimization

James Zhang, Sumit Nawathe, Ravi Panguluri et al.

No citations found for this paper.

Comments (0)