Summary

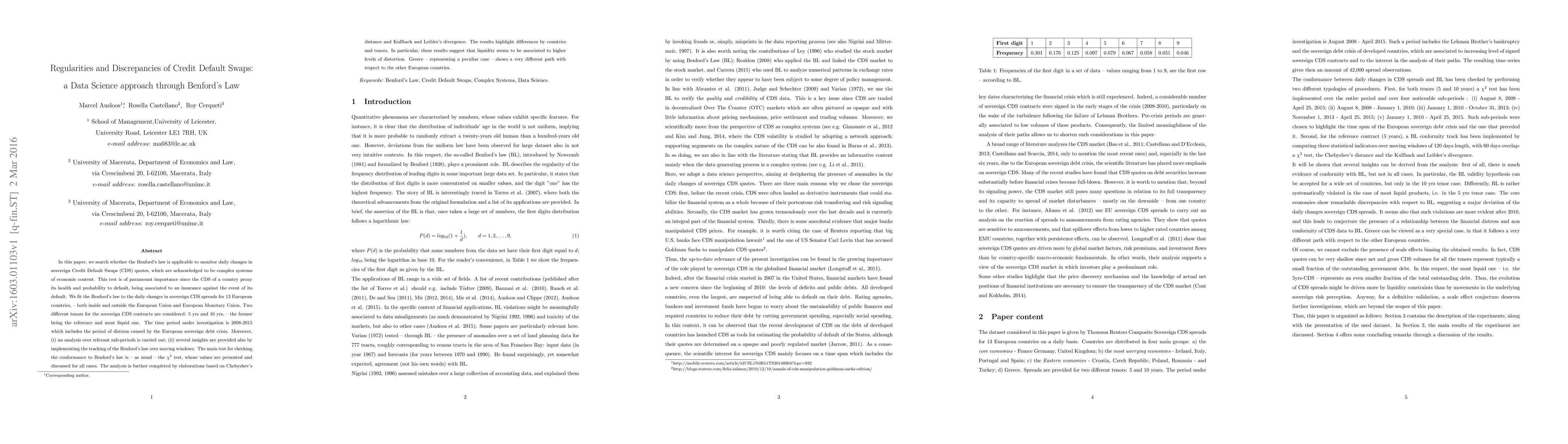

In this paper, we search whether the Benford's law is applicable to monitor daily changes in sovereign Credit Default Swaps (CDS) quotes, which are acknowledged to be complex systems of economic content. This test is of paramount importance since the CDS of a country proxy its health and probability to default, being associated to an insurance against the event of its default. We fit the Benford's law to the daily changes in sovereign CDS spreads for 13 European countries, - both inside and outside the European Union and European Monetary Union. Two different tenors for the sovereign CDS contracts are considered: 5 yrs and 10 yrs, - the former being the reference and most liquid one. The time period under investigation is 2008-2015 which includes the period of distress caused by the European sovereign debt crisis. Moreover, (i) an analysis over relevant sub-periods is carried out, (ii) several insights are provided also by implementing the tracking of the Benford's law over moving windows. The main test for checking the conformance to Benford's law is - as usual - the $\chi^{2}$ test, whose values are presented and discussed for all cases. The analysis is further completed by elaborations based on Chebyshev's distance and Kullback and Leibler's divergence. The results highlight differences by countries and tenors. In particular, these results suggest that liquidity seems to be associated to higher levels of distortion. Greece - representing a peculiar case - shows a very different path with respect to the other European countries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)