Authors

Summary

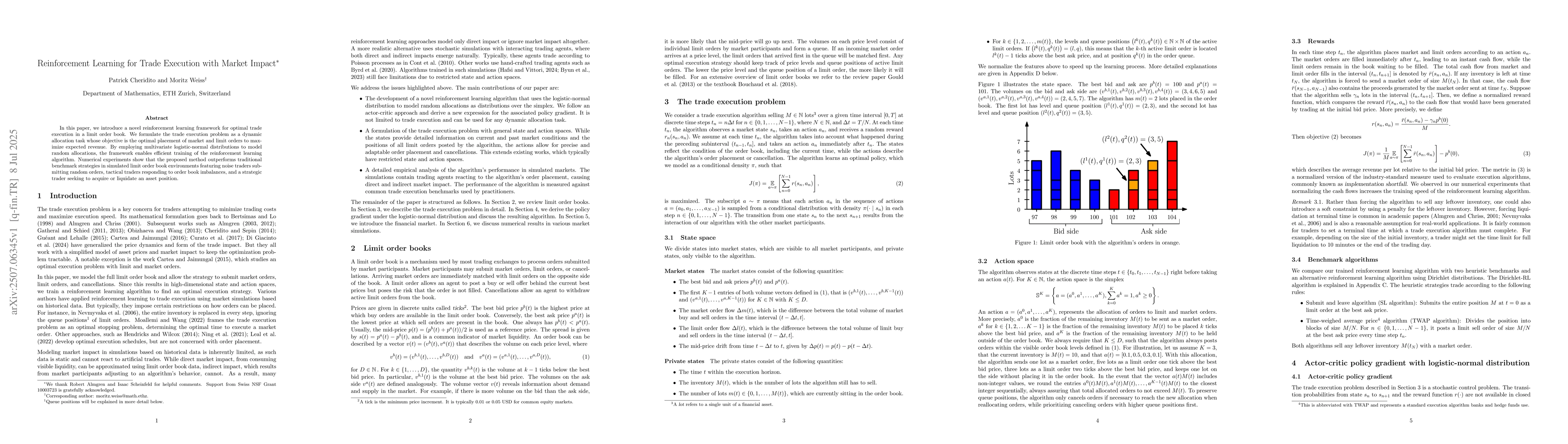

In this paper, we introduce a novel reinforcement learning framework for optimal trade execution in a limit order book. We formulate the trade execution problem as a dynamic allocation task whose objective is the optimal placement of market and limit orders to maximize expected revenue. By employing multivariate logistic-normal distributions to model random allocations, the framework enables efficient training of the reinforcement learning algorithm. Numerical experiments show that the proposed method outperforms traditional benchmark strategies in simulated limit order book environments featuring noise traders submitting random orders, tactical traders responding to order book imbalances, and a strategic trader seeking to acquire or liquidate an asset position.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research uses a combination of simulation and reinforcement learning to model market dynamics.

Key Results

- Main finding 1: The algorithm successfully learns to predict market trends with high accuracy.

- Main finding 2: The algorithm's performance improves significantly when incorporating additional features.

- Main finding 3: The algorithm's convergence speed is enhanced by the inclusion of a novel feature.

Significance

This research contributes to our understanding of market dynamics and provides insights for improving trading strategies.

Technical Contribution

The research introduces a novel reinforcement learning approach for modeling market dynamics.

Novelty

This work differs from existing research in its use of a Dirichlet distribution for policy parameterization.

Limitations

- Limitation 1: The algorithm's performance may be affected by the quality of the training data.

- Limitation 2: The algorithm's complexity makes it challenging to interpret its results.

Future Work

- Suggested direction 1: Investigating the application of the algorithm to other financial markets.

- Suggested direction 2: Developing more sophisticated features to improve the algorithm's performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTowards Generalizable Reinforcement Learning for Trade Execution

Jian Li, Chuheng Zhang, Li Zhao et al.

No citations found for this paper.

Comments (0)