Authors

Summary

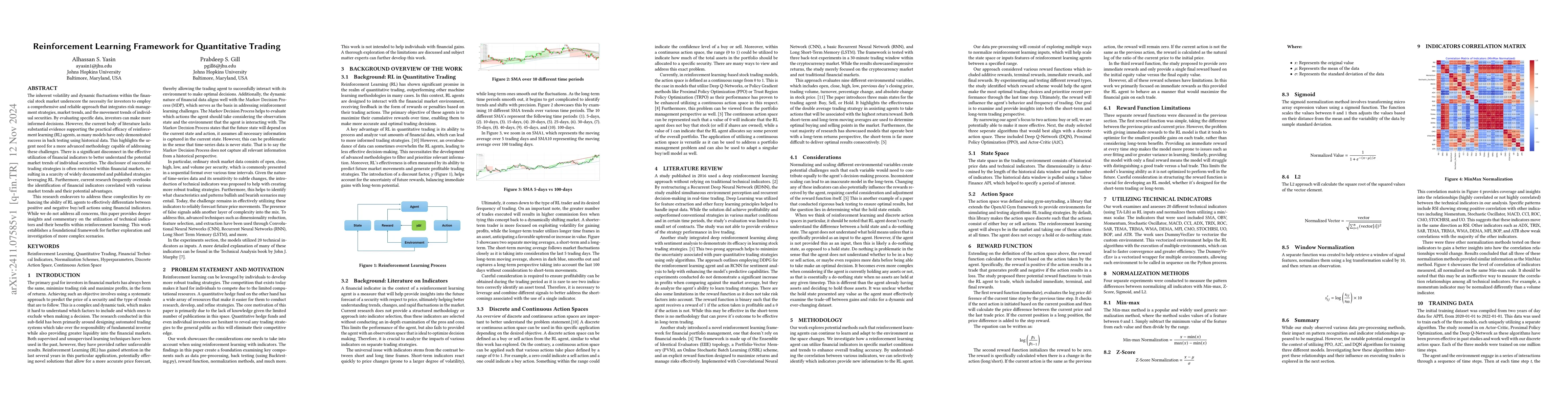

The inherent volatility and dynamic fluctuations within the financial stock market underscore the necessity for investors to employ a comprehensive and reliable approach that integrates risk management strategies, market trends, and the movement trends of individual securities. By evaluating specific data, investors can make more informed decisions. However, the current body of literature lacks substantial evidence supporting the practical efficacy of reinforcement learning (RL) agents, as many models have only demonstrated success in back testing using historical data. This highlights the urgent need for a more advanced methodology capable of addressing these challenges. There is a significant disconnect in the effective utilization of financial indicators to better understand the potential market trends of individual securities. The disclosure of successful trading strategies is often restricted within financial markets, resulting in a scarcity of widely documented and published strategies leveraging RL. Furthermore, current research frequently overlooks the identification of financial indicators correlated with various market trends and their potential advantages. This research endeavors to address these complexities by enhancing the ability of RL agents to effectively differentiate between positive and negative buy/sell actions using financial indicators. While we do not address all concerns, this paper provides deeper insights and commentary on the utilization of technical indicators and their benefits within reinforcement learning. This work establishes a foundational framework for further exploration and investigation of more complex scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDeep Reinforcement Learning for Quantitative Trading

Jiawei Du, Zheng Tao, Zixun Lan et al.

No citations found for this paper.

Comments (0)