Summary

In this paper we will develop a methodology for obtaining pricing expressions for financial instruments whose underlying asset can be described through a simple continuous-time random walk (CTRW) market model. Our approach is very natural to the issue because it is based in the use of renewal equations, and therefore it enhances the potential use of CTRW techniques in finance. We solve these equations for typical contract specifications, in a particular but exemplifying case. We also show how a formal general solution can be found for more exotic derivatives, and we compare prices for alternative models of the underlying. Finally, we recover the celebrated results for the Wiener process under certain limits.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

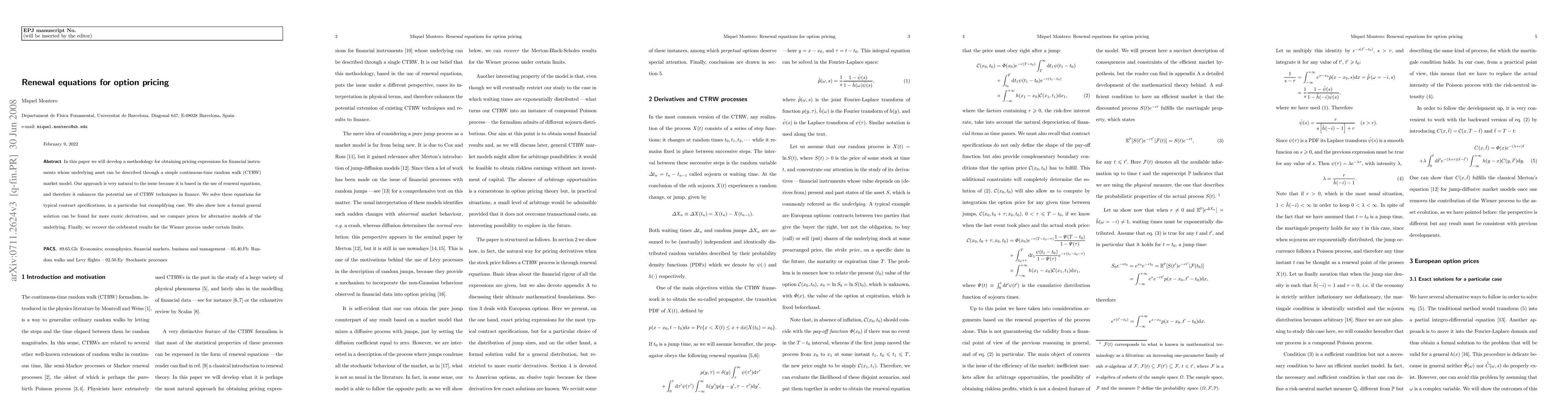

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)