Summary

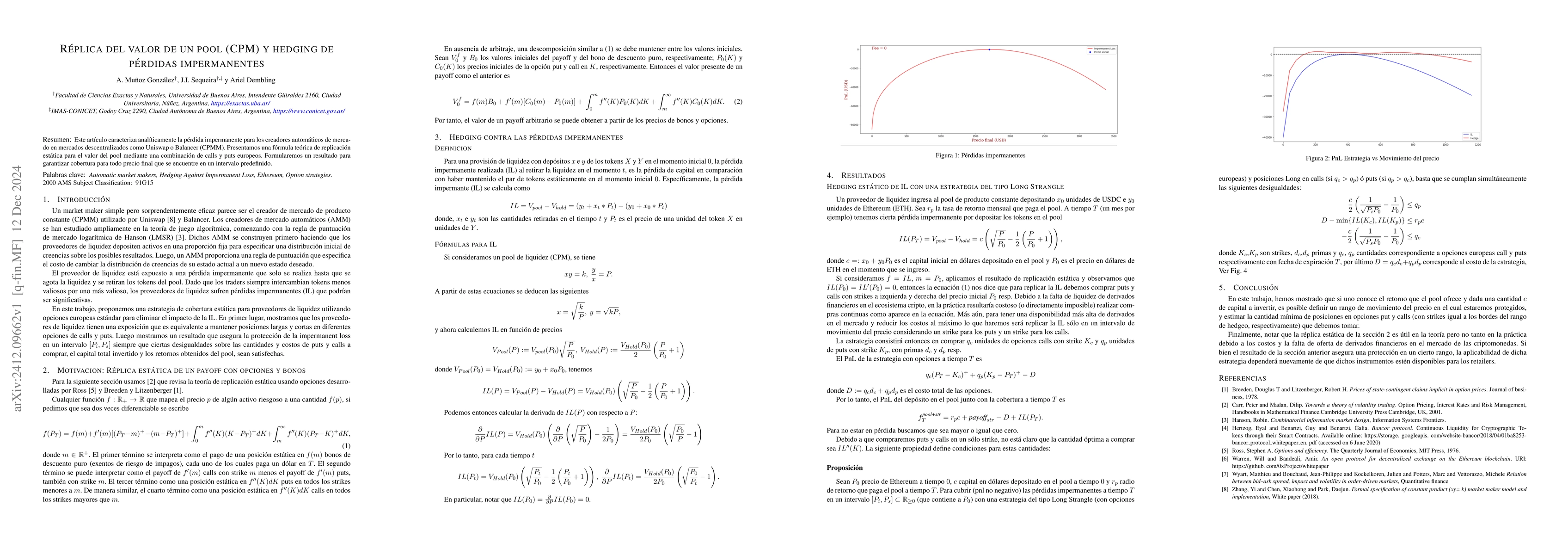

This article analytically characterizes the impermanent loss for automatic market makers in decentralized exchanges such as Uniswap or Balancer (CPMM). We present a theoretical static replication formula for the pool value using a combination of European calls and puts. We will formulate a result to guarantee coverage for any final price that falls within a predefined range.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)