Summary

We explore a simple lattice field model intended to describe statistical properties of high frequency financial markets. The model is relevant in the cross-disciplinary area of econophysics. Its signature feature is the emergence of a self-organized critical state. This implies scale invariance of the model, without tuning parameters. Prominent results of our simulation are time series of gains, prices, volatility, and gains frequency distributions, which all compare favorably to features of historical market data. Applying a standard GARCH(1,1) fit to the lattice model gives results that are almost indistinguishable from historical NASDAQ data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

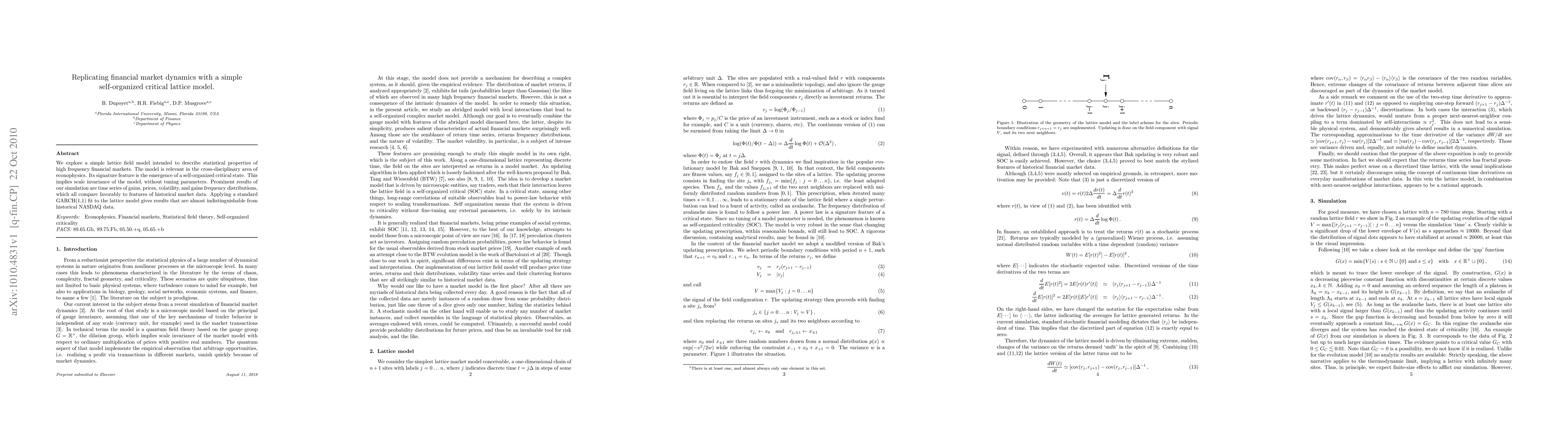

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)