Authors

Summary

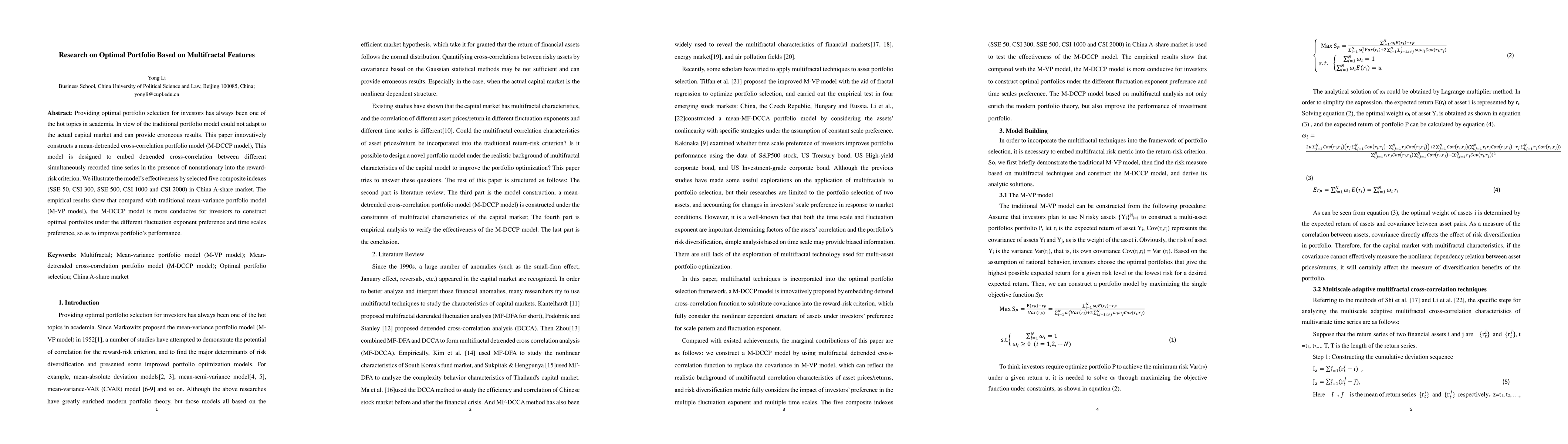

Providing optimal portfolio selection for investors has always been one of the hot topics in academia. In view of the traditional portfolio model could not adapt to the actual capital market and can provide erroneous results. This paper innovatively constructs a mean-detrended cross-correlation portfolio model (M-DCCP model), This model is designed to embed detrended cross-correlation between different simultaneously recorded time series in the presence of nonstationary into the reward-risk criterion. We illustrate the model's effectiveness by selected five composite indexes (SSE 50, CSI 300, SSE 500, CSI 1000 and CSI 2000) in China A-share market. The empirical results show that compared with traditional mean-variance portfolio model (M-VP model), the M-DCCP model is more conducive for investors to construct optimal portfolios under the different fluctuation exponent preference and time scales preference, so as to improve portfolio's performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Frequency-Based Optimal Portfolio with Transaction Costs

Chung-Han Hsieh, Yi-Shan Wong

No citations found for this paper.

Comments (0)